So much for Singapore on Thames: UK corporation tax will be higher than France and Germany

Yesterday, it was announced that corporation tax will rise from 19 per cent to 25 per cent by 2023 for UK companies with annual profits of £250,000 or higher.

Although a new “super deduction” will see companies wipe out their tax bills by investing in property, plant and equipment for the next two years, the tax changes in yesterday’s budget will make corporate tax a more costly affair than in France.

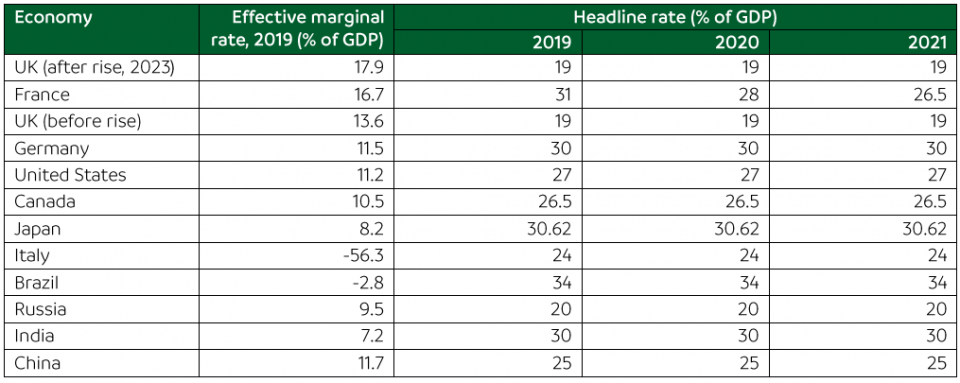

The effective marginal rate in the UK, or the rate actually paid once reliefs are taken in account, could be 17.9 per cent after 2023.

France cut its headline rate from 31 per cent to 26.5 per cent this year, reducing their effective marginal rate of 16.7 per cent.

Moreover, the hike would make the UK among the highest in the G7 and BRIC countries, including China and India, according to data release by the TaxPayers’ Alliance (TPA) this morning.

Commenting on the figures, Mark O’Connell, CEO of OCO Global – a trade advisory consultancy in the City that act as an advisor to the Department for International Trade – said the EU need not have worried that UK would become a low tax, low regulation competitor on their doorstep.

“The proposals in the budget to raise UK Corporate Tax to 25 per cent by 2023 is likely to make foreign direct investment attraction a whole lot more challenging.”

O’Connell pointed out that Ireland, on the UK’s doorstep, is still maintaining a rate of 12.5 per cent and is increasingly positioning itself as the only English speaking country in the EU, now that UK is out.

However, companies with profits of less than £50,000 will remain on the 19 per cent corporation tax rate, while there will be a sliding scale for companies with profits between £50,000 and £250,000.

The chancellor said this would mean that 70 per cent of businesses, 1.4m in total, will stay on their current rate of corporation tax.

Moreover, “the decision [to raise corporation tax] does speak to the seriousness of UK ambition to be more selective about the type of higher value investment it attracts, and those really high GVA investments can avail of R&D credits, new incentives for green economy and Freeports as special economic zones,” O’Connell said.

“CGT and entrepreneur relief seem to be intact or untouched which is also positive for the mergers and acquisitions and capital investment ambitions in the new FDI strategy,” he added.

In addition to the changes in corporation tax, the chancellor also introduced a stealth income tax rise that will raise almost £20bn to help the government pay off a £355bn Budget deficit in 2020-21.

The UK will also freeze the tax threshold at £12,570 from 2022 until 2026, meaning more low paid workers will pay income tax.