Snapshot: Activism, Transition Metals & The Mining Sector

Activist campaigning on transition metals

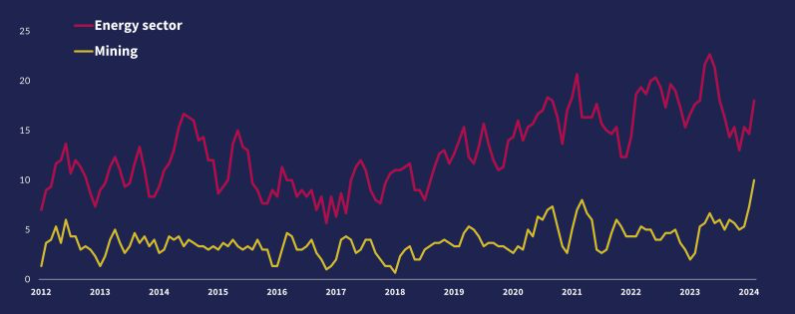

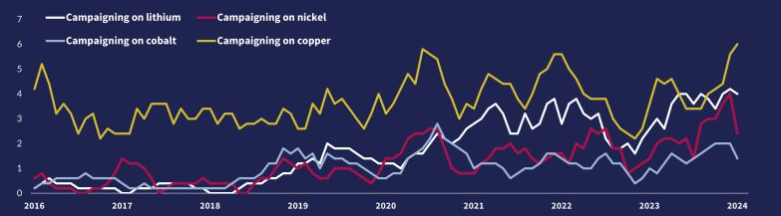

Activist campaigning against the mining sector and on transition metals specifically is rising, driving increased reputational and regulatory risk for companies throughout the value chain. Regulatory moves such as CSDDD create heightened future risk.

Copper has seen significant levels of campaigning on social and environmental impacts for over a decade, with a recent spike in activity around water impacts.

Lithium sees a focus on the environmental and biodiversity impacts, but social concerns remain strong. There is also significant activity around battery recycling.

Nickel campaigning also focuses heavily on environmental impacts, with recent pressure on financial institutions to work towards a ‘deforestation-free’ supply chain.

Cobalt sees a focus on social impacts, with pressure on govts, mining companies, and EV manufacturers in the Global North to act on links to violence and repression.

Click here to get in touch and understand how SIGWATCH can help your business

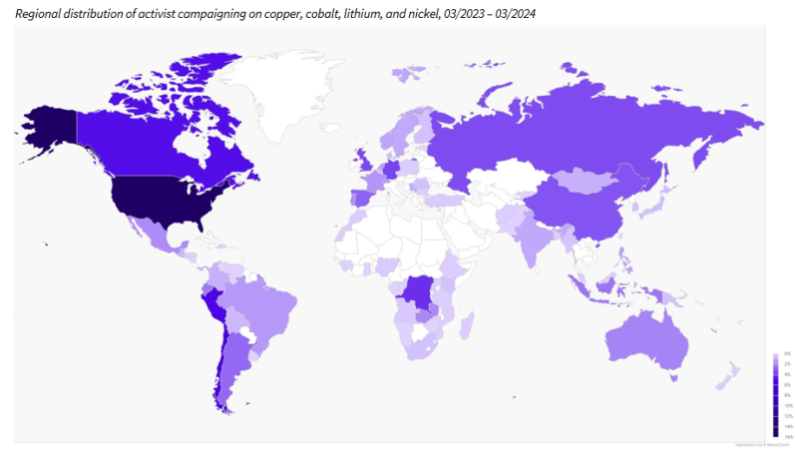

What does the global impact look like?

Activists across the globe work together to deliver reputational impact and drive regulatory innovation on the mining sector and transition minerals.

Groups from the Global North criticise companies for links to social and environmental harms and pressure govts to enact supply chain regulation. Groups in the Global South campaign ‘on the ground’ against the impacts of extraction, also calling for action from govts and companies. Working in coalition, these groups carry each others’ concerns across the globe, amplifying campaigns for maximum impact.

Activists targeting the mining sector in the courts

Overall levels of activist litigation are on the rise. NGOs use of litigation as a tactic raises awareness of issues across stakeholders, delivering reputational and impact and driving legal and financial risk. While the energy industry has been the primary target, litigation levels against mining companies are on the rise.