Slower world economic growth hits Standard Chartered hard

INVESTORS fled emerging markets-focused bank Standard Chartered yesterday after it reported a sharp fall in profits for the third quarter.

The bank had racked up 10 consecutive years of record profits, coming through the financial crisis in strong form because of its focus in Asia and Africa, rather than the western world.

But that has left it vulnerable to a slowdown in emerging markets, and the bank issued its second profit warning of the year.

Pre-tax profits came in at $1.53bn (£947m) for the third quarter, down 19.6 per cent on the year.

And over the first nine months of the year, profits are down 18.9 per cent to $4.8bn.

Corporate and institutional operating profits edged up 1.6 per cent to $2.56bn, while retail and private banking also improved a touch. But commercial banking profits fell 20.5 per cent to $294m.

Analysts believe the bank’s position is only set to get worse.

“We struggle to see a silver lining in the results. To start with, impairments rose 87 per cent year on year in the third quarter,” said Joseph Dickerson from Jefferies.

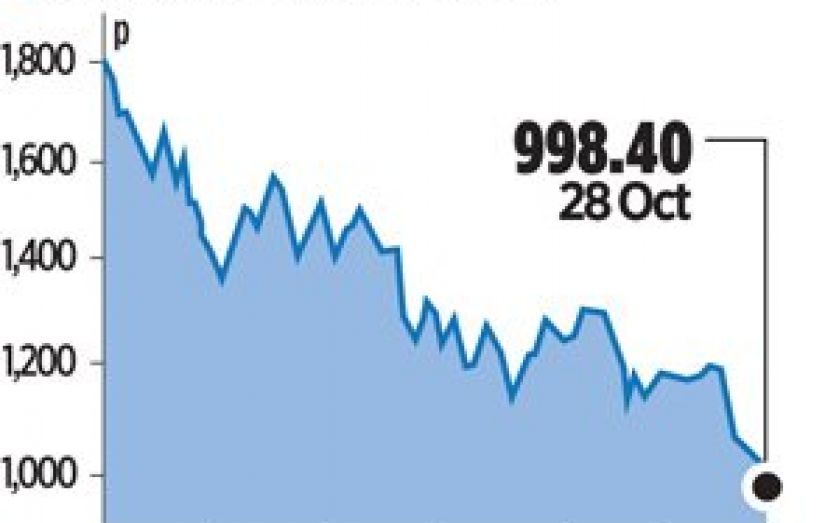

Shares fell 8.8 per cent.