Skandia hits back at Old Mutual overture

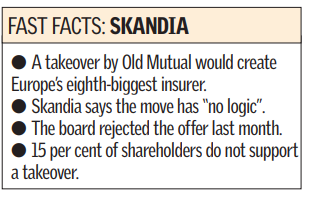

The £3.13bn takeover battle for Skandia, the Swedish insurer, escalated yesterday as the company set out its key argument why it should remain independent.

It listed 16 reasons why a hostile offer from Old Mutual of South Africa was “unacceptable”. Old Mutual said it remained committed to acquiring its target and that it was convinced that a takeover would bring “greatly enhanced growth and reduced risks to shareholders through stable industry ownership”.

Among a battery of reasons why shareholders should reject the offer, Skandia’s board claimed the company had a “compelling” standalone future.

“This is the wrong time to sell,” it said. It added that many of its growth businesses were reaching a critical phase, and that its “turbo plan” would deliver Skr1.2bn (£86m) of increased profits every year over the next five years.

In a direct broadside it slated Old Mutual’s plan for the enlarged business. “We believe Old Mutual’s strategic proposals are flawed — Old Mutual has proposed to sell SkandiaBanken, a core part of Skandia’s Nordic franchise and an increasingly important channel for Skandia’s savings and insurance products.”

Its chairman Lennart Jeansson, said: “The offer is insufficient to compensate shareholders for surrendering control of a business with such compelling and attractive growth prospects.”