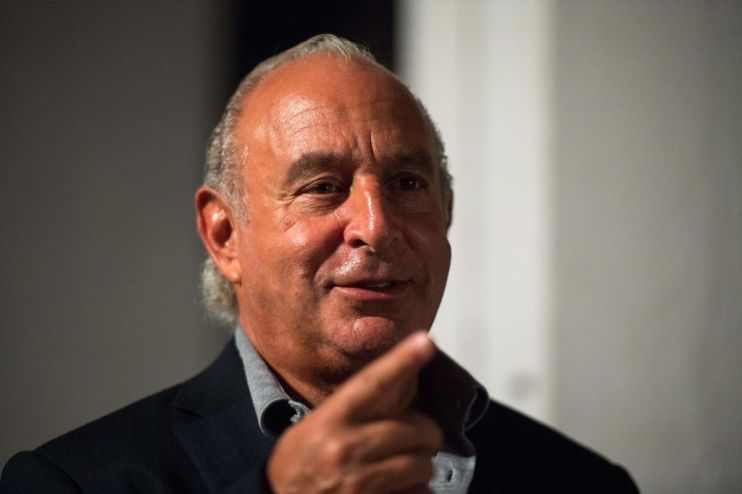

Sir Philip Green’s Arcadia reveals huge losses amid CVA controversy

Arcadia, Sir Philip Green’s high street empire, plunged into huge losses last year before it launched a controversial restructuring drive, new accounts have shown.

The group reported an operating loss of £138m for the year ending 1 September 2018, a sharp decline on the £119m operating profit it made the previous year, according to documents filed to Companies House.

Read more: Arcadia loses another director as interim chairman steps down

Arcadia, which owns brands including Topshop, Dorothy Perkins, and Miss Selfridge, also saw a 4.5 per cent drop in turnover, which fell to £1.8bn.

The group attributed the dip to the “ongoing challenge global market conditions for retailers” and increased competition.

“The retail landscape has changed dramatically over recent years and the increased competition from other high street and online retailers in particular has had a significant impact on our performance,” it said.

Green’s empire is in the middle of implementing a company voluntary agreement (CVA) after a rescue plan was narrowly approved by creditors in June, preventing the group from sliding into administration.

The three-year CVA involves the closure of 23 stores and rent reductions at nearly 200 others, and will see Arcadia receive £50m from its creditors.

The group’s annual results also confirmed that Topshop’s flagship Oxford Street store is to be remortgaged for £185m, a possibility that was first reported earlier this year.

Read more: Arcadia denies it is preparing to dismantle brands

Arcadia denied reports earlier this week that it was preparing to sell off its brands and dismantle the group.

It also emerged this week that the group had lost another director after interim chairman Jamie Drummond Smith quit at the end of August, on the same day as chief operating officer David Shepherd retired.