Short Bitcoin ETF launches after ‘enormous outflows’ led to crypto crash

Data from CryptoCompare shows the price of Bitcoin was slowly recovering throughout last week, moving from around $20,000 to around $21,500. During the last seven days BTC dipped below $20,000 before recovering.

Ethereum’s Ether, the second-largest cryptocurrency by market capitalisation, started the week dropping from around $1,150 to a low under the $1,000 mark, but soon recovered to now trade around $1,250.

Headlines in the cryptocurrency space last week focused on the launch of the ProShares Bitcoin Bitcoin Strategy exchange-traded fund (ETF), which trades under the ticker BITI on the New York Stock Exchange.

The ETF was launched eight months after the launch of the first US Bitcoin futures ETF, and is designed to give investors a way to profit from the decline in the price of the flagship cryptocurrency, and has an expense ratio of 0.95%.

The ETF has seen investors allocate more than 900 BTC into it as it has already become the second-largest crypto-focused ETF in the US by assets under management, behind only ProShares’ futures-based bitcoin ETF BITO, which has the equivalent of 31,000 BTC in assets.

The short Bitcoin ETF was launched after the price of the flagship cryptocurrency dropped to a yearly low under the $19,000 mark over “enormous outflows” from the world’s largest spot Bitcoin ETF, the Purpose Bitcoin ETF (BTCC).

The ETF saw outflows of 24,510 BTC ahead of the crash in its most severe single-day redemption, which meant that the fund had to sell around $500 million in bitcoin, adding selling pressure to an already shaky cryptocurrency market.

While the cryptocurrency market has been slowly recovering Hong Kong-based cryptocurrency lender, Babel Finance, has reached “preliminary agreements on the repayment period of some debts” with counterparties as it improves its liquidity situation after abruptly limiting withdrawals last week.

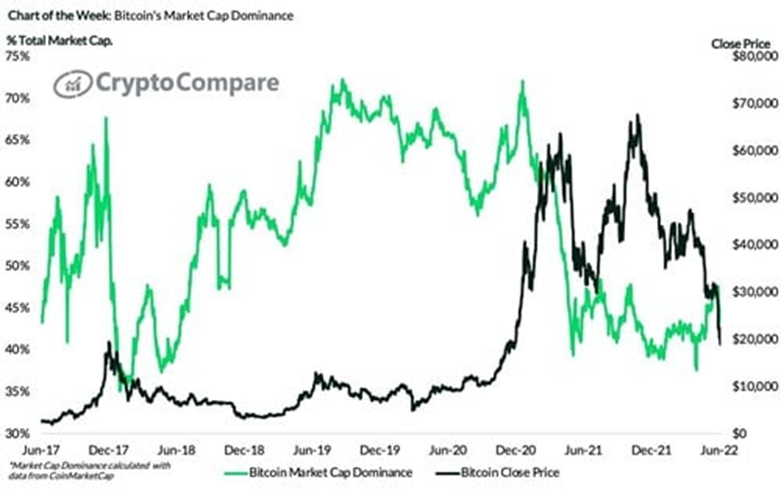

Bitcoin’s dominance of the cryptocurrency space’s total market capitalization has increased over 5% since the Terra-driven cryptocurrency market crash in May, moving from 41.45% at the start of the collapse to over 47% in June.

The move upward coincided with the total market cap of all cryptocurrencies dropping below the $1 trillion mark for the first time since January 2021.

Meanwhile, the Coinbase Derivatives Exchange, formerly known as FairX, has announced the launch of its first cryptocurrency derivatives product this month in a bid to attract more retail traders. The product, Nano Bitcoin Futures (BIT) is rolling out on June 27.

Coinbase Derivatives Exchange said each BIT contract is sized at 1/100th of bitcoin and the initial offering is a USD-settled index future. The product will be available via brokerages rather than through Coinbase itself.

eBay acquires NFT marketplace KnownOrigin

eBay has acquired a non-fungible token (NFT) marketplace called KnownOrigin for an undisclosed amount. The Manchester-based NFT platform was founded in 2018 and has since facilitated $7.8 million in volume.

The deal is seen as an “important step in eBay’s tech-led reimagination, ushering in a new era of digital collecting to the world’s top destination for collectibles”. KnownOrigin allows artists and collectors to create, buy, and sell NFTs via blockchain-based transactions.

The acquisition comes as banking powerhouse Citigroup selected Swiss cryptocurrency custody firm Metaco to develop the bank’s digital assets custody solution. The bank, which holds about $27 trillion in assets under custody, is set to integrate Metaco’s Harmonize crypto custody platform into its infrastructure.

The move will allow Citi to develop a platform that allows clients to store and settle digital assets “seamlessly and securely”.

While large companies move deeper into the cryptocurrency space, to some a larger victory was achieved this week when the UK government backtracked on implementing a proposed version of a controversial rule that would require those sending funds to private cryptocurrency wallets to collect the identification details of recipients.

Solana Labs unveils mobile platform and a flagship android phone

Solana Labs has announced the launch of a flagship Android smartphone called Saga. The device is being purpose-built for web3, which spans decentralised finance platforms and NFT marketplaces, among others.

The smartphone is set to feature a 6.6-inch display, 12 GB of RAM, and 512 GB of storage as well as private key security measures built in. Solana Labs also announced the launch of the Solana Mobile Stack (SMS), which is an open-source software kit designed to enable the development of native Android apps around the Solana blockchain.

Solana’s move into the telecom industry is being managed by a new subsidiary called Solana Mobile. The Saga smartphone is reportedly gaining access to a decentralised application store for mobile devices and will cost $1,000, with a $100 deposit necessary for pre-orders.

As Solana ventures into the smartphone world, the blockchain engineering firm responsible for Cardano’s research and development, has announced a one-month delay to the launch of the long-awaited Vasil hard fork.

The hard fork is set to bring a “massive performance improvement” according to Charles Hoskinson, Cardano’s founder. The upgrade is a major one that involves four different Cardano Improvement Proposals (CIPs).

Francisco Memoria is a content creator at CryptoCompare who’s in love with technology and focuses on helping people see the value digital currencies have. His work has been published in numerous reputable industry publications. Francisco holds various cryptocurrencies.

Featured image via Unsplash.