Shock record wage growth amplifies risk of 14th straight Bank of England interest rate rise

Workers’ pay is rising faster than expected and at among the quickest paces on record in a sign that the Bank of England will deliver a 14th straight interest rate rise next month, official figures out this morning reveal.

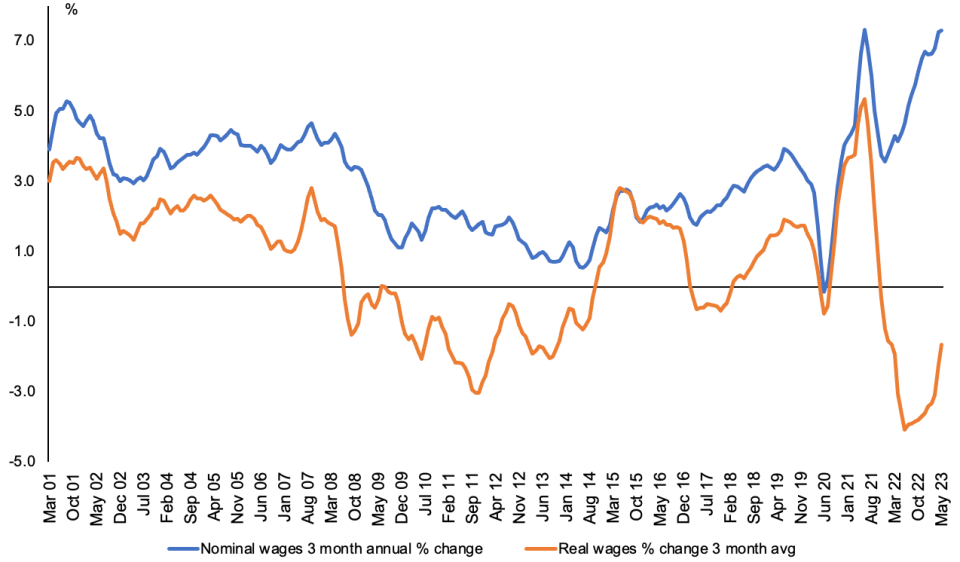

Pay excluding bonuses rose 7.3 per cent over the three months to May on an annual basis, the same rate of increase as the last quarter after an earlier estimate was revised up, according to the Office for National Statistics (ONS).

The number was above the City’s expectations for a 7.1 per cent increase and over the Bank of England’s estimate. It also matched the highest rise the ONS has tracked since it started reporting data in 2001.

Including one-off bonuses, wages jumped 6.9 per cent over the same period. The City thought the figure would hit 6.8 per cent.

Pay growth was strongest among City and factory workers, up nine per cent and 7.8 per cent respectively.

Governor Andrew Bailey and the rest of the nine-strong monetary policy committee (MPC) is concerned elevated wage settlements will raise businesses’ fixed costs, incentivising them to keep lifting prices. That could mean inflation – stuck at 8.7 per cent in May – falls much slower than expected. It has been above the Bank’s two per cent target since July 2021.

Bailey yesterday in his speech at the annual bankers’ Mansion House dinner the Bank is looking for signs of wage acceleration cooling. In its policy statement that accompanied last month’s rate rise, the MPC said “further tightening in monetary policy would be required” if wage settlements remain high.

“Today’s data confirm that the labour market is still too hot, as pay growth remains uncomfortably high,” Yael Selfin, chief economist at KPMG UK, said.

Markets reckon there is a greater chance of the Bank repeating last month’s 50 basis point increase than selecting a smaller rise, which would take borrowing costs to 5.5 per cent. Peak rate expectations have climbed to 6.5 per cent.

Sky high inflation has compelled staff to ask their employers’ for pay rises that help shield their living standards. Workers’ pay increases have been cancelled out by rising prices for more than a year and a half now, according to ONS data.

Real wages are getting closer to rising

Britain’s labour market has held up extremely well despite predictions that the country is headed for its first recession outside of the pandemic since the 2008 financial crisis. But cracks are emerging.

Unemployment jumped to four per cent from 3.8 per cent in the three months to May, the ONS said today.

Vacancies, though down 85,000, are still running at more than 1m, historically high, which chancellor Jeremy Hunt said was “pushing up inflation even further”.

While a strong jobs market has helped keep GDP growth just about positive at 0.1 per cent in the three months to March, it is inflation afloat by fuelling consumer spending.

The employment rate leapt to 76 per cent, up 0.2 percentage points over the last three months, amounting to an additional 102,000 people in a job.

Economists have said inflation is being intensified due to firms hiking pay to lure workers amid a smaller labour force, while growth is being pegged back by businesses being unable to find appropriate staff to carry out roles.

The ONS also said economic inactivity – people not in a job or looking for one – fell 141,000, possibly caused by Brits returning to the jobs market to replenish their finances in response to rising living costs.

Long-term sickness keeping people out of the workforce remains a problem, with the number of people economically inactive due to health problems up more than 410,000 since the onset of the pandemic, though that was about 30,000 lower than the previous three months. Overall inactivity is now 281,000 higher compared to the quarter before the pandemic, down from the level in the three months to April.