Shell weighs up UK investment plans as windfall tax bites

Shell is still considering whether to cut back on future energy projects in the North Sea, after Chancellor Jeremy Hunt hiked the windfall tax last year.

A spokesperson from the energy giant confirmed to City A.M. that the so-called Energy Profits Levy will factor into its decision making and that it was now assessing projects on a case-by-case basis.

This comes after Shell announced last week that it would be paying tax in the UK for the first time since 2017, with an estimated $2.4bn (£2bn) hit in tax liabilities.

It confirmed an earnings slide ahead of its fourth quarter results next month, following three bumper windows of trading including a monster £9.2bn second quarter of trading.

However, the spokesperson explained that this did not mean the UK and European Union have received a sudden boost to their coffers from their respective levies because payments will not be made until later this year.

While the UK levy and EU Solidarity Contribution will lead to outflows from Shell, the overall cost of the earnings hit be below $2.4bn due to its ability to use historic losses and investments to alter its tax.

Shell has committed to invest £25bn in new UK energy projects domestically over the course of the current decade, with 75 per cent focused on low and zero carbon projects.

If it pulled out from investments, it would be a further blow for the UK’s energy ambitions after Harbour Energy recently announced that had pulled out of the latest licensing round for North Sea oil and gas projects as a result of the windfall tax.

Hunt ramped up the windfall tax from 25 per cent 35 per cent in November, while also extending the duration of the levy from 2025 to 2028.

This is on top of the North Sea’ special corporation tax rate of 40 per cent, hiking the effective tax on oil and gas operator profits to 75 per cent.

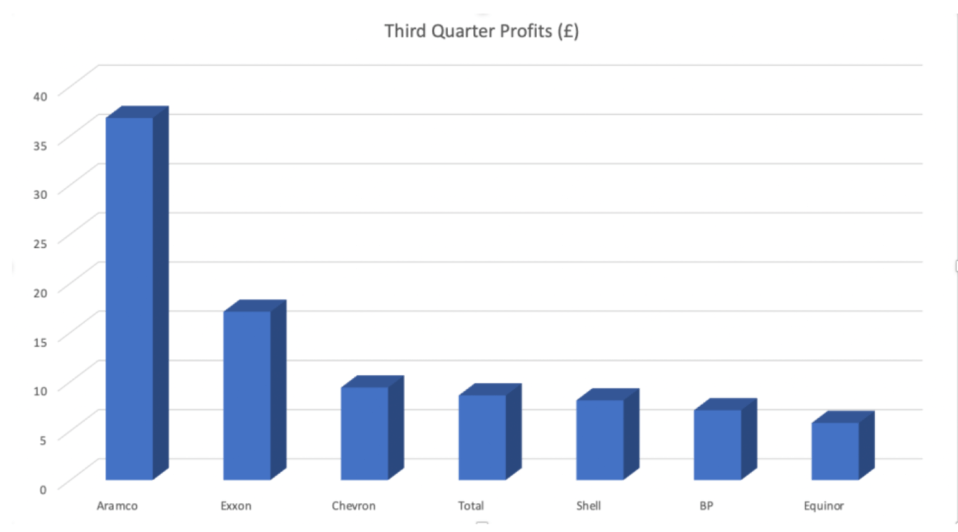

The government has sought to harness soaring profits across oil and gas producers, fuelled by Russia’s war with Ukraine, to raise funds to tame household energy bills.

In combination with the new electricity generator levy, Downing Street is looking to raise as much as £55bn for support packages for households and businesses.