Shell sweetens shareholders with chunky buybacks even as profits fall

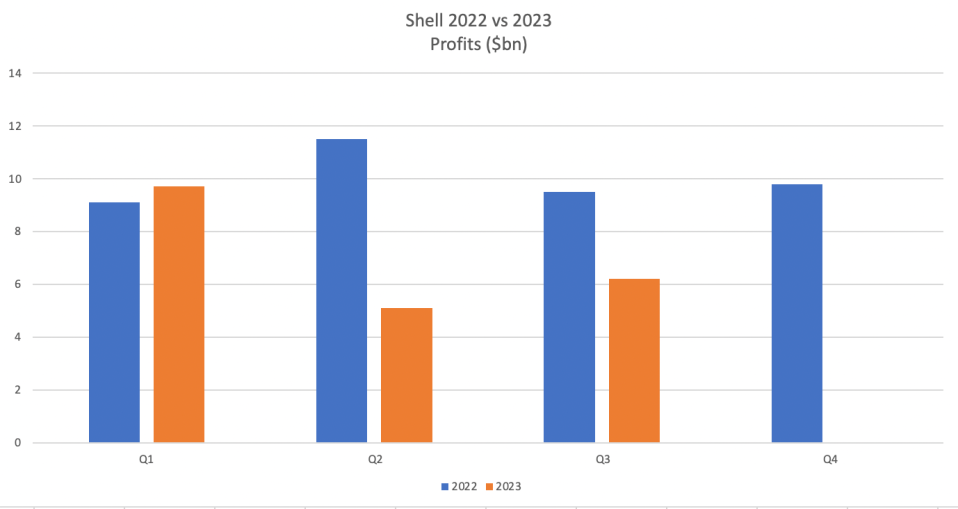

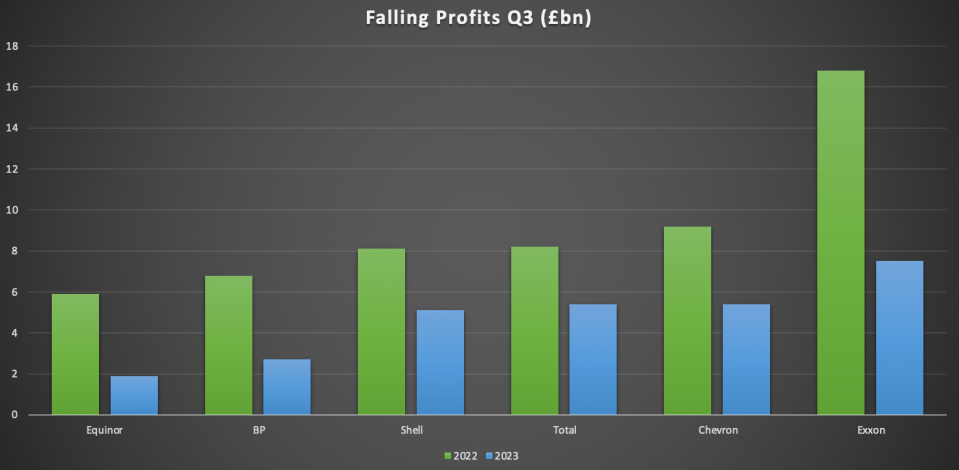

Shell joined its rivals in posting a year-on-year decline in profits over the third quarter this year, with oil and gas companies failing to match 2022’s record earnings amid easing commodity prices.

The energy giant revealed earnings of £5.1bn over the three months of trading, down 38 per cent on the £8.1bn posted 12 months ago.

This follows similar plummets in profits from Chevron, Equinor, Exxon, Total and British rival BP over the past week.

Wael Sawan, Shell’s new chief executive officer, still considered the performance to be “strong” amid “volatile commodity markets.”

He said: “We continue to simplify our portfolio while delivering more value with less emissions.”

In context, there is some validity to this viewpoint — with profits still historically high despite the downturn.

Market rallies following Russia’s invasion of Ukraine last February enabled the world’s latest fossil fuel producers to cash in — triggering a political backlash that led to windfall taxes and immense scrutiny of the industry’s future green goals.

This saw BP and Shell both pledge heavy spending commitments for low-carbon projects in the UK, proposing investment plans of £18bn and £25bn respectively over the current decade.

Green commitments remain under the microscope with Tessa Khan, executive director at climate group Uplift slamming the latest profit update from Shell.

“Firms like Shell spend a lot of money persuading us that they are shifting to renewables — which would lower energy costs — when in fact this makes up a fraction of investment, with the majority remaining in fossil fuels,” she said.

Meanwhile, Labour is still committed to ending new oil and gas licences, and is in favour of sustaining the windfall tax in British waters, while also scrapping investment relief for producers.

However, it appears shareholders — the first priority of any major company — are more interested in the ‘bread and butter’, wanting companies to push forward with oil and gas production while being garlanded with hefty dividends and buybacks.

Shell keeps its focus on oil and gas

Sawan confirmed this morning that Shell is commencing a £2.8bn buyback programme for the next three months, bringing the buybacks for the second half of 2023 to £5.3bn, well in excess of the £4.1bn announced at its capital markets day in June.

This takes the total announced shareholder distributions for 2023 to £18.8bn.

Campaigning group Global Witness estimates Shell paid shareholders £30bn since Russia’s invasion of Ukraine last year.

Jonathan Noronha-Gant, senior campaigner, said: “Shell’s shareholders remain some of the biggest winners of Russia’s brutal war in Ukraine and ongoing global instability. The turmoil in fossil fuel markets allows Shell to rake in enormous profits — but instead of investing in clean energy, the company has doubled down on oil, gas, and shareholder pay-outs.’’

Yet such a strong showing for shareholders is clearly benefitting the company — which is up 1.54 per cent in this morning’s trading despite the decline in profits.

Jamie Maddock, energy research analyst at Quilter Cheviot, said: “In a move likely to please investors, Shell increased its share buyback program, signalling confidence in its financial health. The dividend remains stable, yet the company has again slightly reduced its anticipated spending, demonstrating a cautious approach in an unpredictable market.”

However, it has not been as easy for some of its competitors with BP failing to impress shareholders with its dividend offerings after its own downturn in profits.

Its share price slid on Tuesday following its third-quarter results, while its share price remains well below other contenders.

Shell, however, has combined its share buybacks and handouts with a clear plan towards continued oil and gas investment and containing capital expenditure — which it has also matched with bullish rhetoric.

Sawan has defended the need for oil and gas for decades to come while also slashing its short-term oil and gas reduction pledges, with the chief executive describing radical reductions as “dangerous and irresponsible” earlier this year.

Environmental campaigners and investors who run strict environmental, social and governance screens will be displeased, but Shell seems to be reaping the benefits of a renewed strategic focus on hydrocarbon production, as laid down by boss Wael Sawan when he took over at the turn of the year…

Russ Mould, senior investment analyst AJ Bell

By contrast, BP is reeling from the exit of its chief executive Bernard Looney, while its more aggressive push towards green energy has been less assuring to investors worried about returns from renewables.

Sawan has instead reassured investors that these oil and gas producers are still committed to their primary operations.

Russ Mould, senior investment analyst at AJ Bell, said: “Again, environmental campaigners and investors who run strict environmental, social and governance screens will be displeased, but Shell seems to be reaping the benefits of a renewed strategic focus on hydrocarbon production, as laid down by boss Wael Sawan when he took over at the turn of the year.

“The goal is to maximise the value of existing assets and generate profits and cash flows which will then fund increased dividends, as well as share buybacks, and investment in low-carbon energy production.”

Oil and gas companies will have no choice but to eventually shift towards renewables and low carbon technology, and criticism over the slow pace of its transition is fair — but with shareholders its first priority, it is no surprise to see businesses acting like businesses.