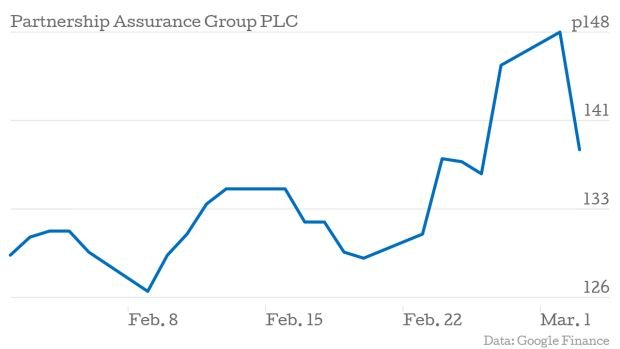

Partnership Assurance share price down as annuities drop

Retirement specialist Partnership Assurance saw shares fall by 6.59 per cent yesterday after reporting new business premiums of £791m in 2014, around two thirds of their level in 2013.

The company also announced a £100m bond issue to majority shareholder Cinven, with the stated aim of gaining “further financial flexibility” to grow the business in the UK retail, defined benefits and US care markets.

Chief executive Steve Groves was positive about the firm’s performance in what he described as the “disruptive market” which has emerged after George Osborne’s sweeping pension reforms, announced in last year’s Budget. The chancellor did away with rules that meant people were effectively required to buy an annuity with their retirement savings. Partnership saw new business sales of individual annuities fall from £1.08bn in 2013 to £466m last year.

However, Groves told City A.M. that he does not believe the new rules signal the end of the annuity market. “I think we have been seeing artificially low market numbers,” he said. “I think there’s about £3.5bn out there with people who have deferred making a decision until the changes come into force.”

Groves said the company had also shielded itself from the impact of Osborne’s reforms by “prioritising margin over volume”, and taking action on costs. “The business has adapted to the post-Budget world, and I can see some exciting opportunities for profitable growth,” he commented.