‘Shame on them’: Skipton Group boss slams banks for not passing on rate hikes to savers

Skipton Group today criticised rival high street lenders for failing to pass on higher interest rates to savers.

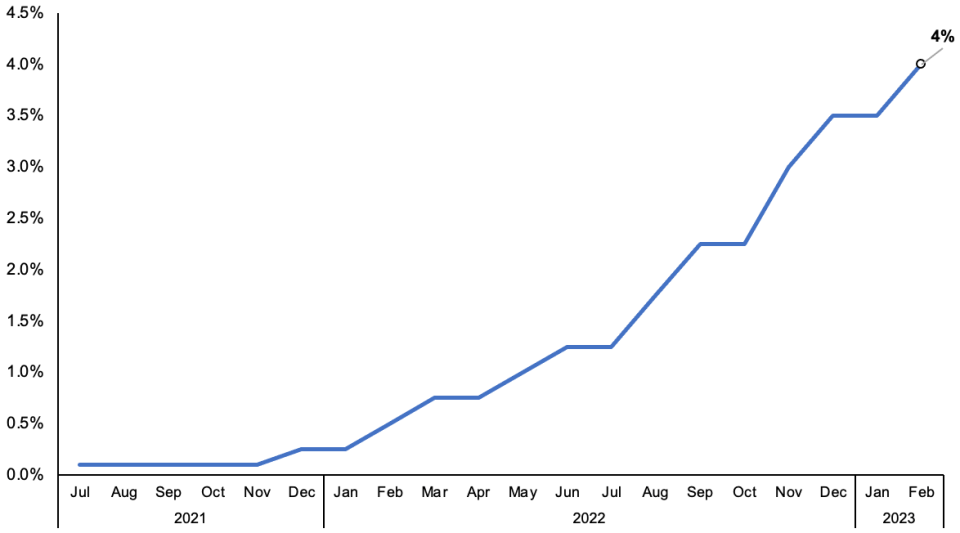

Britain’s banks have seen their income boosted by the Bank of England’s attempt to stave off inflation with a succession of ten straight interest rate hikes. The base rate now stands at four per cent – the highest since the financial crisis.

“We’ve followed the interest rates up on our savings range whereas… the market practice has been for people to maybe leave the savings rates down, which then supports the margins and the profits of the institutions who could make more profit,” Stuart Haire, Skipton Group’s chief executive, told City A.M.

“Shame on them,” he said.

Haire said the group “could have put £100m to profit, which perhaps some of the high street banks would have done, but we chose to give it back because we’ve not got shareholders.”

Haire’s comments come as the mutually-owned group, which runs Skipton Building Society and the UK’s largest estate agency Connells Group, reported a 10 per cent increase in profit in 2022, which it said was driven by strong growth and improved interest margins.

The group said it also delivered a record year of lending in 2022, completing nearly 30,000 mortgage loans worth over £5.8bn.

Haire added that it paid out over £100m to members through “above market average savings rates”. Its average savings rate in 2022 was 1.16 per cent, which he claimed was above the market average.

Base rate has risen sharply over the last year or so

Membership grew five per cent to 1.14m in 2022, while its saving balance grew 13.6 per cent.

Despite the challenging economic environment, the bank has seen low levels of arrears. The proportion of mortgage accounts in arrears by three months or more stood at only 0.17 per cent at the end of 2022.

“We can almost name them” Haire said, adding “we treat those people incredibly carefully because they’re in difficult situations.”

However, he admitted “it is inevitable arrears will take up”. The low level of arrears at the moment was partly a result of timing, Haire said, but he also stressed the company’s base “tends to be marginally more affluent”.

Haire also said the group had invested in providing all of its members with an energy performance certificate report, which allows them to have an energy efficiency scan of their building. “It’s quite an expensive service but we’ve given to our members for free,” he said.