SEC probes if Ethereum is security as ‘final battle’ looms

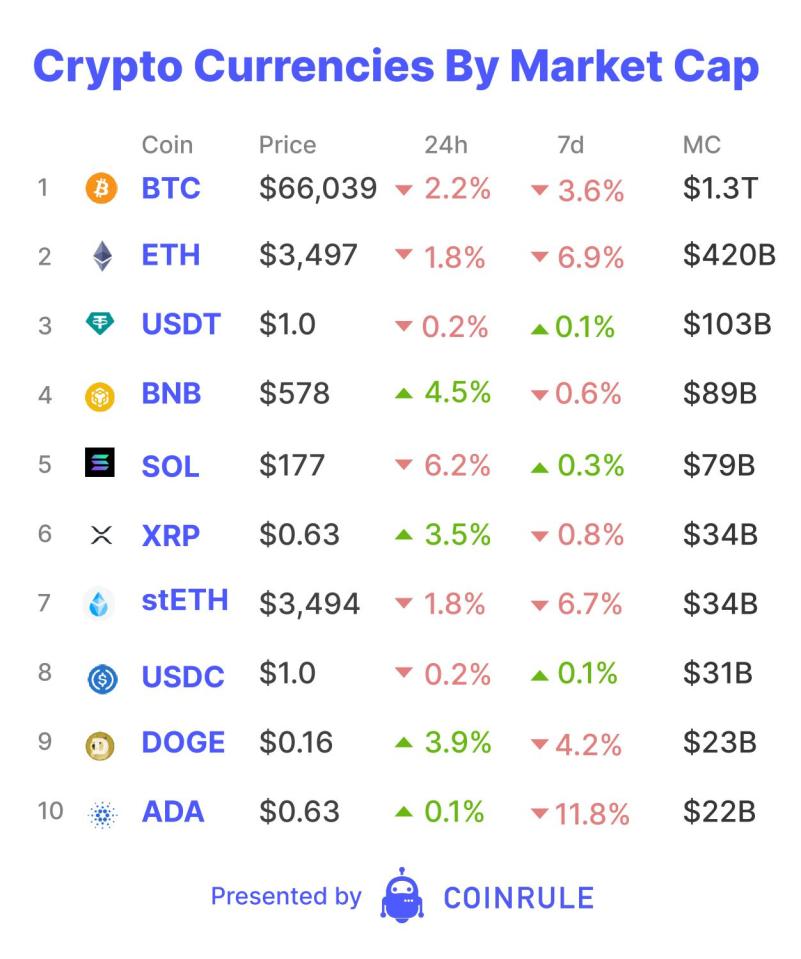

Each day, Coinrule will run through the state of the digital assets market for Blockbeat, your home for news, analysis, opinion and commentary on blockchain and digital assets.

In reference to computer games, there is a concept of the ‘final boss’ in crypto folklore. For crypto, the ‘final boss’ is the government. The SEC’s decision to issue subpoenas to crypto companies are an attempt by the agency to classify Ethereum as a security and therefore put it under its jurisdiction. SEC Head Gary Gensler may well see this as the final chance to keep the ‘genie’ of decentralised finance in the bottle by severely increasing the regulatory risk for crypto projects. The main case centres around Ethereum’s transition to a ‘Proof-of-Stake’ consensus algorithm. According to the archaic rules of the so-called Howey Test, the promise of returns makes ETH the asset now resemble an investment contract too closely.

Does the case have legs? The SEC’s legal track record against crypto companies is poor. Only last week, a federal judge in Utah said that the SEC abused its authority in a crypto case. Purely on the merit of the Howey Test, the SEC could have a point. But wider questions arise: should a legal framework from 1945 determine the course of an entirely new type of technology? Blockchains will enable a fundamental transformation of financial markets. It’s not technology but regulations that have to adapt to a new world. Even in the unlikely case that the SEC wins, crypto entrepreneurs would simply avoid the United States, a Pyrrhic victory.