Screenshot: Will London ever be ready for tech IPOs?

This week

**Media Moment of the Week: Volkswagen’s awkward U-turn

**Will London ever be ready for tech IPOs?

**Amazon goes bonkers for bots

Media Moment of the Week: Volkswagen’s awkward U-turn

There are few things as grating as the forced joviality of April Fool’s Day and it should, in this writer’s opinion, be cancelled. That said, there was one stunt that went so hilariously wrong this week that it almost made me change my mind.

When Volkswagen issued a statement saying it was rebranding as Voltswagen to mark its commitment to electric vehicles, it should have been a harmless (if unfunny) April Fool’s joke.

The only issue was that the world’s second-largest carmaker did so by accident on 31 March, and several major publications and analysts took it seriously. Cue a grovelling apology from Volkswagen, a drop in its share price and potentially even a probe by the SEC into market manipulation. Well played, guys.

Will London ever be ready for tech IPOs?

It really hasn’t been the best week for the City. First, used-car platform Cazoo, founded by British tech entrepreneur Alex Chesterman, confirmed plans to list in New York through a $7bn (£5bn) Spac deal. It’s an eye-watering valuation for a company that launched just over a year ago, and another demonstration that blank-cheque listings are all the rage these days. It also promises bumper paydays for both Chesterman and the Daily Mail publisher, which holds a 20 per cent stake.

It was not quite such good news for the London Stock Exchange, which had reportedly been lobbying hard for Cazoo to list at home. And as if that weren’t enough, the City took a further blow on Wednesday when Deliveroo delivered what is now being described as the worst IPO in London’s history. The dismal debut saw the delivery giant’s shares plunge 30 per cent in early trading (the same cut it takes from restaurants from commission, as many gleefully pointed out), with £2bn wiped off its market value on the first day. Hopes of a rebound evaporated on Thursday, too, as shares dipped even further. It’s awful news for the 70,000 or so retail investors who took part in the float and also a pretty bad look for chancellor Rishi Sunak, who had hailed the company as a “British success story”.

Some of the concerns with Deliveroo’s float, as I discussed last week, were specific to the company. From worries over workers’ rights and potential changes to employment law to scepticism over its path to profitability, there were signs the float was somewhat on the frothy side. Some analysts have also pointed the finger at the banks, saying the IPO was priced too highly. Media analyst Ian Whittaker says Deliveroo was “always a poor choice to have as the poster child” for London.

But there’s something else rather more structural going on here. Deliveroo opted for a dual-class share structure, allowing founder Will Shu to retain much of the voting power. It’s a popular system in the US (Facebook and Google parent Alphabet both use it), but is viewed with considerable scepticism in London. In fact, several of the major blue-chip investors who publicly distanced themselves from the IPO cited the share system as one of the reasons for doing so.

There’s also a wider sense that London just doesn’t get tech. The City’s old-school investors — ever the traditionalists — want steady profit growth and dividends. They’re simply not willing to wait around while a loss-making tech firm scales up. This issue was stated explicitly by Cazoo founder Chesterman, who told the Evening Standard that the UK was “an amazing place to build a business” but warned the IPO process was “challenging for companies investing in high growth”. The figures speak for themselves, too. In the last 20 years less than four per cent of British startups have chosen to list in London.

Of course, the City is not blind to these problems. Earlier this year the Hill Review set out a number of recommendations for revamping London’s listing scene, including liberalising rules around Spacs and dual class shares. These reforms, it is hoped, will encourage companies — particularly tech — to IPO in London. In reality, though, investors will be looking at the evidence, and the double whammy of Cazoo and Deliveroo in a single week will do significant harm to London’s reputation as a home for tech. All eyes will now be on Darktrace, the British cybersecurity giant plotting a £5bn London listing. After Deliveroo’s flop, London is desperately in need of a new hero.

Amazon goes bonkers for bots

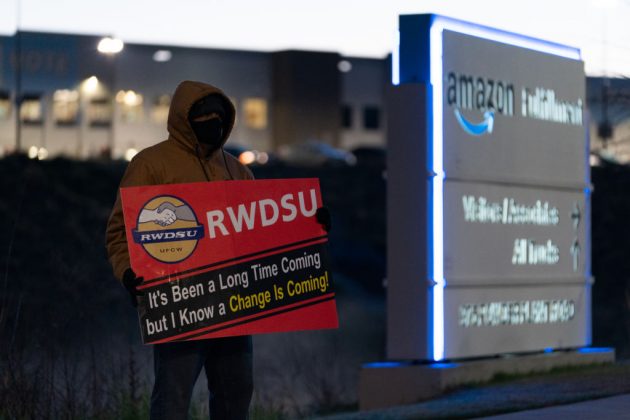

Despite my many dealings with the good folk of the public relations world, I’m no expert in PR. Nevertheless, I’d humbly suggest that trying to crush the threat of unionisation by releasing a flood of quite obviously fake bots on social media is not the best strategy.

This, however, appears to be exactly what Amazon is doing. Amid a tense vote in Alabama over whether Amazon warehouse workers will form a union, a crop of accounts have sprung up on Twitter claiming to be employees of the ecommerce giant. The accounts have been posting gushing praise about Amazon while preaching the downsides of unionisation. The only issue, though, is that they’re hardly convincing.

Many of the accounts, which are named @AmazonFC (fulfilment centre, not football club) following by a first name, were created only a few days ago. Some have been around for a few years but, inexplicably, appear to have changed names. Yet more have fake profile pictures taken straight from Google Images.

To make matters even more confusing, Amazon does genuinely employ so-called ambassadors to sing their praise on social media. A spokesperson confirmed that at least one of the accounts was fake and Twitter has suspended several more. It’s still not clear, though, how many are genuine employees, bots or simply trolls.

It comes after Amazon went on a bit of a social media rampage at the end of last week, getting in a rare public row with US politicians including Elizabeth Warren over the company’s tax bill and the way it treats workers.

All of this amounts to a rather curious new PR policy for the tech giant. It reportedly stems from a command from Jeff Bezos himself, who is said to be annoyed that Amazon executives weren’t pushing back hard enough against criticism. But the company is walking a tightrope, especially at a time when scrutiny is at its most fierce. Either way, though, if Amazon wants to build trust among the public, unleashing an army of bots is hardly the way to do it.

The algorithm recommends:

- Good news for Glastonbury fans. The festival will be hosting a livestream gig in May featuring acts such as Haim, Jorja Smith and Coldplay. It’s also bagged £90,000 for the UK’s culture recovery fund to ensure it can run next year.

- Apple has put the major record labels in its sights, leading a $50m investment in a platform that allows artists to retain their master recording rights.

- The free press in China took a further blow this week when BBC journalist John Sudworth was forced to flee to Taiwan after his reports proved inconvenient to Beijing.

Got a story? Drop me a line at james.warrington@cityam.com or on Twitter