Scottish Power boss hammers huge levy on electricity generators

One of the leading figures in the energy industry has slammed the Government’s decision to impose a 45 per cent tax on electricity generators.

Keith Anderson, chief executive of Scottish Power, warned the new Electricity Generator Levy will create a “five-year long corridor of uncertainty for investors” which risks undermining the UK’s green ambitions.

He told City A.M.: “In times of national crisis everyone should be playing their part. I’m deeply disappointed that renewables have been singled out – it seems it’s a recession made by gas, but a recovery to be paid for by renewables.”

The energy boss argued the new tax risked hampering clean energy projects that were essential for reducing the country’s “gas dependency” and for reaching its net zero ambitions.

Anderson also raised concerns over the continued investment relief in the Energy Profits Levy for oil and gas companies, with no equivalent support for green energy projects.

He said: “I do not understand why renewables are being taxed at similar levels to oil and gas and those businesses are being given added incentives to invest in even more fossil fuels.”

His concerns were shared by rival electricity generator specialist SSE, which called on the Government to treat the cause, rather than the “symptoms of the energy crisis.”

SSE chief executive Alistair Phillips-Davies said: “We look forward to hearing more from government about how it will support the massive investment in homegrown clean energy that this country needs to end our dependence on expensive imported gas and cut bills in the future.”

He also confirmed SSE believed in paying its fair share of tax, and was open to a “well-designed levy on extraordinary profits, where they are actually realised,”

Comments from both energy bosses follow Hunt unveiling a 45 per cent levy on electricity generators – which is expected to raise £14bn over the next five years.

The Chancellor wants to harness bumper profits from across the energy sector to pay for further support for households and businesses grappling with their energy bills.

However, this comes with the Government looking to ensure supply security following Russia’s invasion of Ukraine, and a squeeze on European gas supplies.

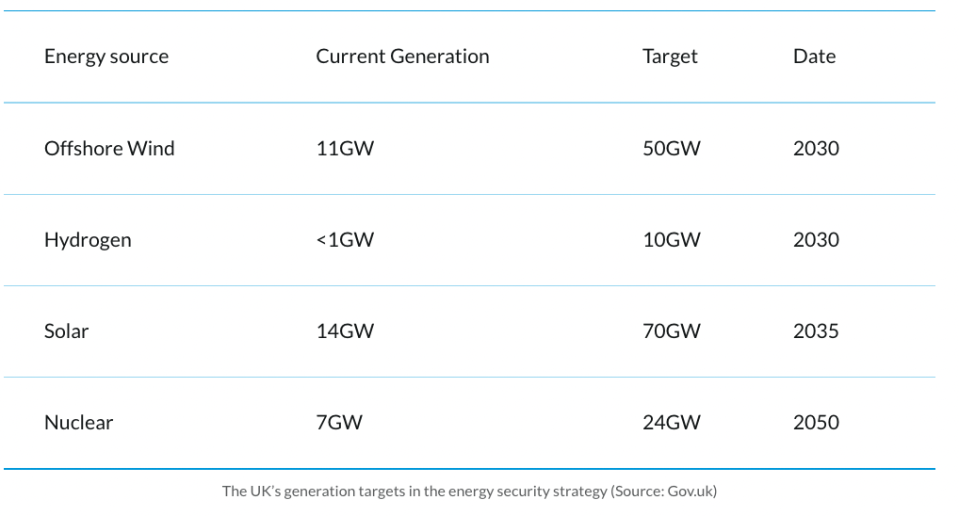

As part of its energy security strategy, Downing Street is aiming to boost offshore wind from 11GW to 50GW by 2050, hydrogen from less than 1GW to 10GW, and to renew oil and gas exploration following a massive licensing round earlier this year.

North Sea industry hit with higher taxes

Hunt also unveiled a 10 percentage point hike and a three year extension to the Energy Profits Levy.

This takes the overall tax rate for oil and gas companies in the North Sea to 75 per cent, when combined with the special corporation tax rate.

Combined with the electricity generator levy, this could raise a combined £55bn over the next five years.

Harbour Energy, the largest oil and gas producer in the North Sea, confirmed to City A.M. it was “reviewing the impact” on its business from “yet another change in the tax regime for UK oil and gas companies.”

A spokesperson said: “The levy, as currently designed, disproportionately impacts independent UK oil and gas companies and does not target genuine windfall profits.”

JohnMacdonald, director of strategy at the Adam Smith Institute, warned the constant tinkering with tax regimes risks making the business environment “uncertain” for energy producers.

He also argued the electricity generator levy undermines the Government’s green agenda.

He said: “Extending the levy to low carbon power generators such as wind and nuclear flies in the face of the Government’s green agenda. They cannot claim to be committing to tackling emissions while penalising the very companies that will lead the way to a carbon neutral future.”

The Government has been approached for comment.