Scorching inflation sends UK debt interest bill to record-high £19bn

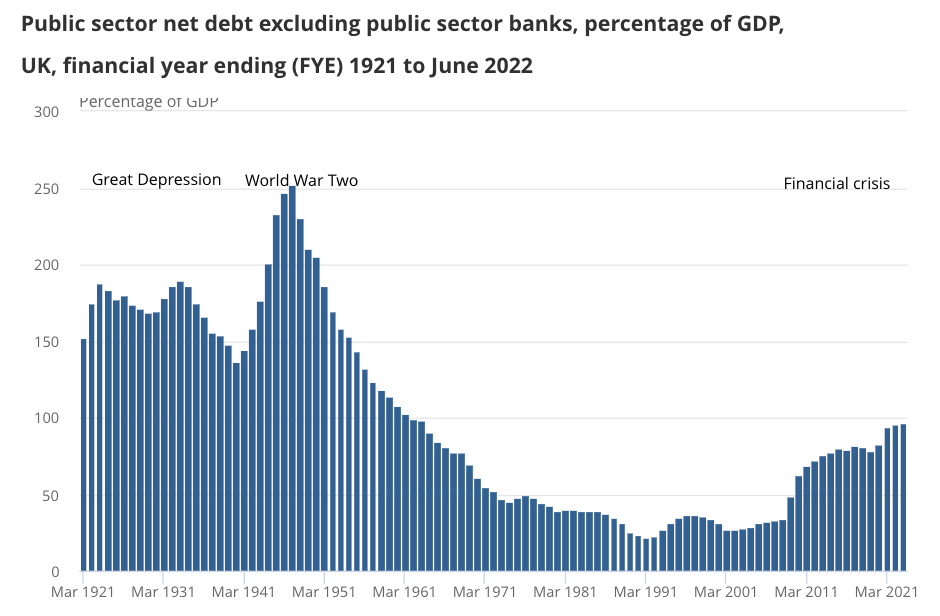

Scorching inflation has ballooned the UK’s debt interest bill to its highest level since records began in the early 1990s, official figures published today revealed.

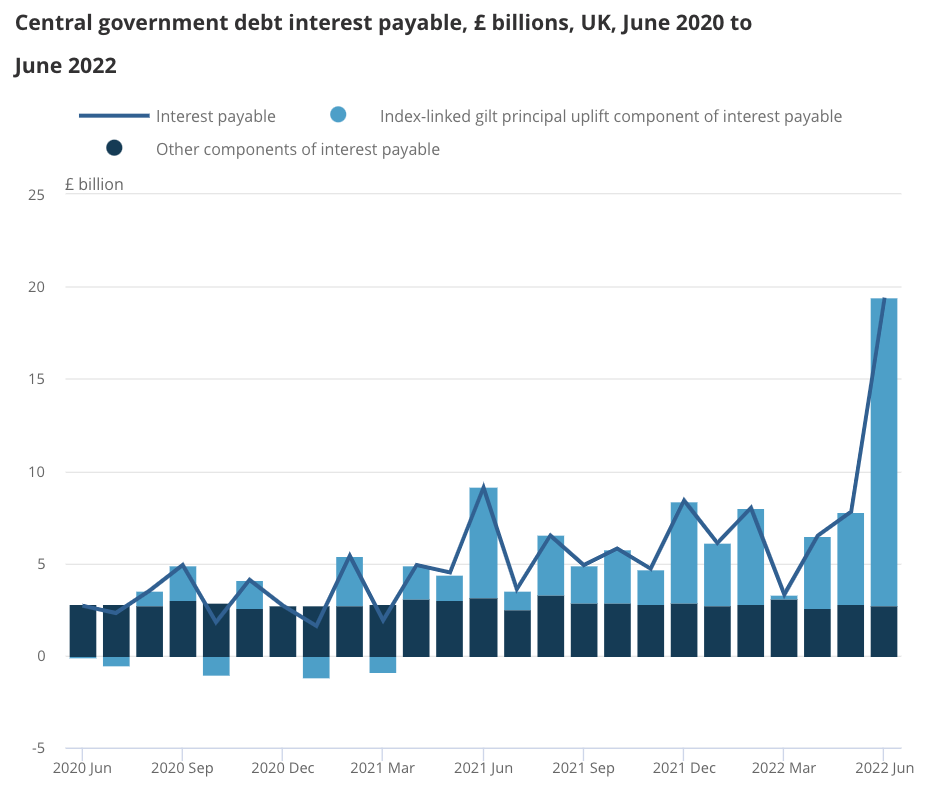

The amount of money the UK had to pay investors holding government debt in June more than doubled over the last year, topping £19bn, up from £9.1bn in June 2021, according to the Office for National Statistics (ONS).

A large proportion of Britain’s debt pile is linked to the retail price index (RPI), an old measure of inflation, meaning interest payments rise in line with the rate of price increases.

The month-on-month increase from two months earlier in RPI determines the interest payment adjustment. The index jumped over three percentage points in April.

Some economists argue a high debt interest bill does not hit the UK’s public finances due to the payments being spread over a long period.

Nonetheless, that record interest payment increase lifted borrowing June to nearly £23bn, above the Office for Budget Responsibility’s (OBR) £22.3bn forecast, but below the City’s expectations.

A further inflation surge over the coming months, peaking in October when the energy watchdog raises the cap on bills again, will swell the debt interest bill.

“RPI inflation likely will surge again in October, when the energy price cap will jump, boosting interest payments in December,” Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said

“In addition, both gilt yields and the market-implied path for bank rate are higher now than when the OBR produced its forecasts in March. Accordingly, we estimate that debt interest payments will total £104bn in 2022/23, £21bn more than the OBR anticipated,” Tombs added.

Chancellor Nadhim Zahawi said: “The government has taken action to strengthen the public finances, and in their latest forecast the OBR assessed that we are on track to get debt down.”