Scale of house price boom in prime London revealed

AVERAGE house prices have doubled to over £1m in dozens of wards inside and surrounding London in the past decade, soaring despite the effect of the financial crisis.

Research by property group Savills and the Property Database, based on Land Registry figures, shows the huge rise in prices recorded in the most sought-after parts of the south east.

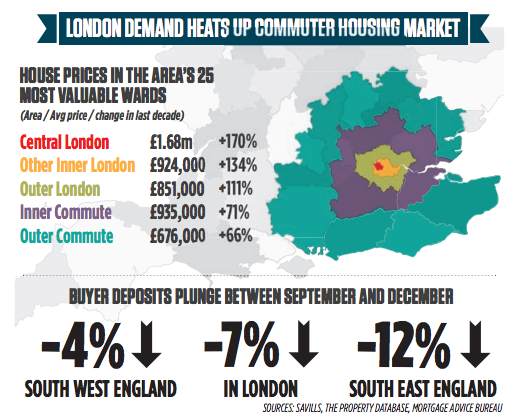

The average house sold in the 25 most expensive wards in the very centre of London went for £1.677m last autumn, up 170 per cent in the 10 years to September 2013.

Astonishingly, the average house sold in these areas has risen in price by 57 per cent in the last five years alone, completely bucking the national trend since the 2008 crash.

“Central London has led the way since the crisis, with the initial recovery led by an exchange rate advantage and international demand,” said Lucian Cook, Savills’ director of residential research.

Prices have also been resilient to the general trend in the most well-heeled parts of the commuter belt. In the area around London described by Savills as “inner commute”, the 25 priciest wards have seen prices rise by 71 per cent in a decade, with an average buyer spending £935,445.

Prices in the capital rose by seven per cent in the year to January, and the average price has risen to over half a million pounds since this time last year, Rightmove’s latest house price index, released today, suggests.

But the average deposit in much of the south of England dropped significantly over the last part of 2013, the Mortgage Advice Bureau (MAB) also announced today.

The MAB says that the typical deposit dropped by seven per cent in London and 12 per cent in the south east during the period between September and December alone.