Savills sales drop 45 per cent in a year

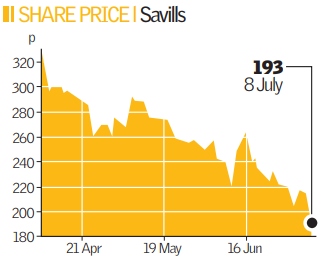

Shares in property giant Savills dived more than 10 per cent yesterday after the firm said sales in its residential business were 45 per cent down year on year.

Piling misery on the battered housing market, Savills warned that the cost of prime property in London (homes priced between £1m and £5m) fell by 7.5 per cent in the first half of the year.

The news caused its shares to fall sharply. Yesterday afternoon the stock closed at 193p. Lucian Cook, director of residential research at Savills now expects the value of luxury homes in the capital to fall by a quarter by the end of 2009.

“This really does show a realignment between vendor and buyer expectations. We are back to 2006 pricing levels now,” he told CityA.M.

In a gloomy trading update, Savills said that both its residential business, which accounts for around 20 per cent of group profit, and its larger commercial arm, were suffering because of the protracted slump in the property market.

“Trading conditions for our UK and US commercial capital markets businesses and our UK residential and mortgage broking businesses have continued to deteriorate with volumes down significantly on the comparable period in 2007,” the group said in statement.

It added: “These difficult trading conditions have now spread to many parts of Europe where the number of transactions is declining as financing becomes more difficult to obtain.”