Saudi Aramco revels in record profits amid booming oil and gas prices

Saudi Aramco (Aramco) has smashed its quarterly profit record set in May, powered by soaring energy prices and chunky refining margins following Russia’s invasion of Ukraine.

The state-backed energy giant reported a massive 90 per cent rise in second-quarter earnings on Sunday, surpassing analyst expectations.

Its net profit rose to $48.39bn for the quarter to June 30, up from $25.42bn in the earlier quarter.

Analysts had expected a net profit of $46.2bn , according to the mean estimate from 15 analysts submitting estimates to news agency Reuters.

In the earnings report, Aramco chief executive Amin Nasser revealed he expects “oil demand to continue to grow for the rest of the decade, despite downward economic pressures on short-term global forecasts,”

The company has declared a dividend of $18.8bn in the second quarter, in line with its own target, which will be paid in the third quarter.

Aramco shares have risen over 25 per cent this year as oil and natural gas prices have climbed to multi-year highs, as Western sanctions against Russia tightened an already under-supplied global market.

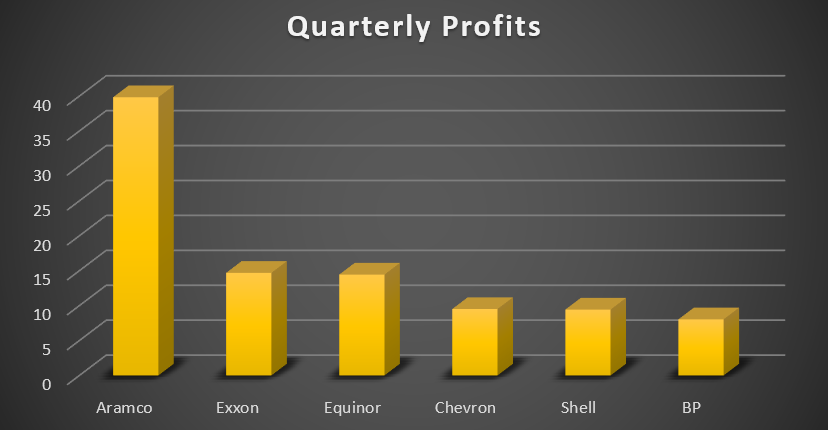

The energy giants joins other oil majors which have reported strong results in recent weeks, such as ExxonMobil, Chevron, Shell, BP and Total Energies.

Aramco revealed its average total hydrocarbon production was 13.6m barrels of oil equivalent per day in the second quarter.

Meanwhile, capital expenditure increased 25 per cent to $9.4bn in the second quarter compared to the same period in 2021.

It also announced plans to continue investing in growth, expanding its chemicals business and developing prospects in low-carbon businesses.

Nasser concluded: “But while there is a very real and present need to safeguard the security of energy supplies, climate goals remain critical, which is why Aramco is working to increase production from multiple energy sources — including oil and gas, as well as renewables, and blue hydrogen.”

Aramco’s results follow conflicting reports on oil demand for the rest of the year – with the International Energy Agency forecasting rising consumption levels while OPEC has downgraded its predictions.

The company’s massive profits and the subsequent rebound in oil prices indicates investors expect demand to still grow significantly this year.