Samsung warns of falling profits in mobile group

SAMSUNG Electronics’ fourth quarter profits are expected to be hit by falling smartphone shipments and the impact of a special employee bonus estimated to be worth nearly 1 trillion South Korean won (£570m).

Yesterday the world’s largest smartphone maker said it expects to fall short of analysts’ expected earnings of 8.8 trillion won by 18 per cent, with profits of only 8.3 trillion won.

The six per cent decline on 2012’s results is the first in five years for Samsung and it is thought that the company’s high bonuses and struggling sales of flagship Galaxy S and Note smartphones – losing out to Apple’s iPhone in primary markets such as the US and Japan during the holiday season – are to blame.

“Even taking into account one-off costs, the (fourth-quarter) profit is lower than expected. Samsung has not provided details, but smartphone profit may have fared worse than expected, given increased marketing expenses,” said IBK Investment & Securities analyst Lee Seung-woo.

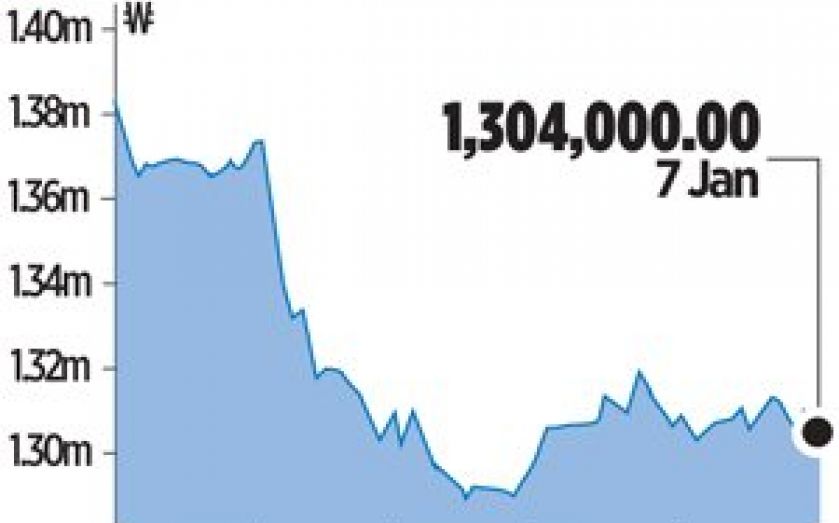

Samsung shares saw their first annual decline in 2013 in five years, partly due to the company’s conservative shareholder return policy.

Like most South Korean companies, Samsung has kept its dividend yield low at around one per cent or less, which is the primary reason its shares are not seen as being as valuable as global peers.

Samsung’s fourth quarter results will be released on 24 January.

The company’s share price fell 0.23 per cent yesterday on the news to close at just above 1.3m won.