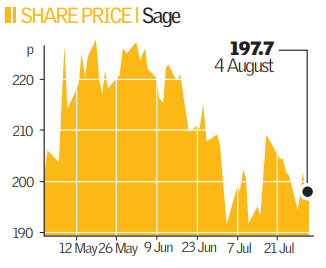

Sage expects to deflect the credit crunch

Business software maker Sage yesterday said that its second quarter profits were up by 12 per cent, fuelling hopes that it will hold strong in the face of challenging market conditions.

Despite increased competition in the small to medium enterprise (SME) market, the company continued to grow ahead of market expectations, posting an increase of 9 per cent in sales. Pre-tax profits were up by 12 per cent to £122.6m.

An increase in the sales of subscription services to Sage’s 5.7m SME clients helped drive profits up, as firms tried to save money on back office functions by using IT.

The firm also reduced net debt in the period to £532m compared to £556m on 31 March.

But the strong results were tempered by a note of caution from the firm’s management, stoking fears that the effects of the credit crunch on SME businesses might still end up hurting Sage.

“This is a cautious trading update, using careful language to highlight the ‘uncertain’ and ‘challenging’ markets the company faces, particularly in the UK and US,” said Derek Brown, analyst at Seymour Pierce.

Chief executive Paul Walker said: “Our businesses continue to show resilience in uncertain and challenging markets.

“We remain cautious on the economic outlook although our large customer base, geographic diversity and strong product offering provide good support going forward.”