Ryanair cuts ticket prices while earnings plummet

Shares in low cost airline Ryanair sank 22 per cent yesterday after the company warned it may make a €60m (£47.4m) loss this year, as high oil prices eat into margins.

It said it had made profit after tax in the first quarter of €21m- a drop of 85 per cent- but the carrier yesterday made the audacious move of cutting its average fares by 8 per cent, in a bid to attract a high volume of customers.

Most of its rivals have increased the cost of flying to cover sky-high oil prices.

Some analysts yesterday said their business model was unsustainable. Howard Wheeldon, an analyst at BGC Partners, said the firm needed to double its ticket prices and cut the number of flights to mitigate rising fuel prices.

The Irish airline now spends half of its operating costs on fuel, compared to 36 per cent in 2007.

Its fuel bill rose 93 per cent to £289.6m in the first quarter of its financial year to the end of June.

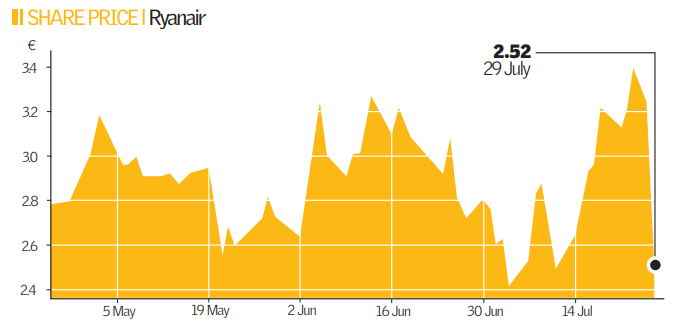

Ryanair chief executive Michael O’Leary said: “The outlook for the remainder of the fiscal year which is entirely dependent on fares and fuel prices remains poor…consumer confidence is plummeting, and we believe this will have an adverse impact on fares for the rest of the year.” Its shares closed at €2.52 last night.

City Views: Is this the end of Ryanair’s model of low cost flights?

Adrian Cunningham (Reconciliation at Schroders): “They will have to raise their prices otherwise they are liable to go out of business. I think flying for 5p is ridiculous, it’s too cheap and that makes you very wary that the planes are safe. Look at Qantas last week, there was a big question over how safe that plane was.”

Joel Romaner (Accountancy Tutor at Kaplan): “I don’t think Ryanair’s plan is sustainable. They either have to raise prices or cut costs and they will find it hard to cut costs. I don’t think local carriers are doomed as demand will always be there. People who are going on holiday expect low prices, so there will always be demand.”

Piers Fallowfield-Cooper (Founder of Mind Star): “This is an audacious gamble and flies in the face of conventional wisdom, but they may get away with it. Ryanair’s users are very price sensitive. Volume will make up for the loss on margins. If they have got a lot of cash in the bank, their strategy might allow them to last it out.”