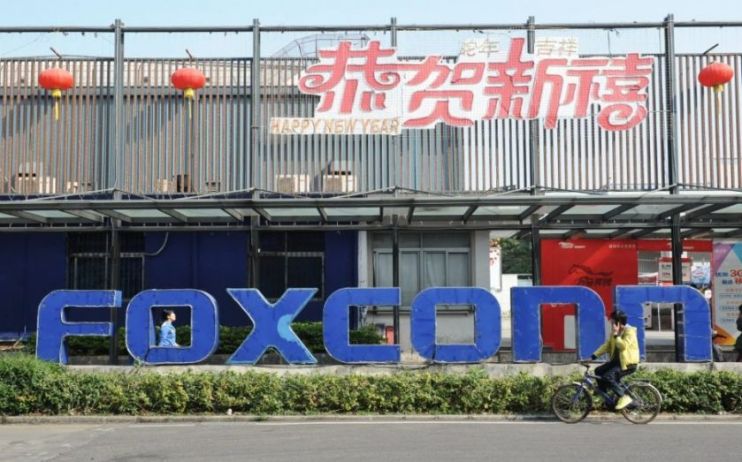

Rising tensions: Foxconn to be fined by Taiwan over investment in China

Apple supplier Foxconn is expected to be fined by the Taiwanese government for an unauthorised investment in China, as tensions between the two states continue to build.

Foxconn, the world’s largest maker of contract electronics, had bought a stake in Chinese chip giant Tsinghua Unigroup in July, which went against new rules imposed in Taiwan.

However, Foxconn confirmed on Friday that it had agreed to sell its stake in the group.

The Taiwanese government imposed new rules which curb investment flows into China earlier this year, forcing local businesses to have all foreign investments approved by the economy ministry.

On Saturday, Taiwan’s economy ministry said it will ask Foxconn on Monday for a “complete explanation” regarding the investment.

“As for the fact that the investment was not declared beforehand, the amount will still be calculated in accordance with the formula and the penalty will be imposed in accordance with the law,” it wrote.

Prior to the ministry’s statement, Foxconn said the investment had “remained unfinalised”, after it had been reported the electronics supplier had failed to seek approval from the government.

Foxconn, which builds Apple’s iPhones, said it had agreed to sell its stake to Chinese firm Yantai Haixiu for $772m (£593.7m) on Friday.

In a statement, Foxconn told City A.M.: “Previously, based on financial investment considerations, Foxconn Industrial Internet Co Ltd invested indirectly in Tsinghua Unigroup via its unit Xingwei Fund. The fund invested in Shengyue Guangzhou, which in turn invested in Beijing Zhiguangxin, the controlling shareholder of Tsinghua Unigroup.

“With the approach of year end, the process remained unfinalised. In order to avoid uncertainties from further delays or impact to investment planning and the flexible deployment of capital, the Xingwei Fund will transfer its entire holding in Shengyue Guangzhou to Yantai Haixiu. After the transfer is completed, FII will no longer indirectly hold any equity in Tsinghua Unigroup.”

Taiwan has been particularly cautious on investment into the country, mirroring hawkish new curbs introduced by the US earlier this year which restrict China’s access to advanced technology with militaristic applications.

The UK has also sought to stamp out internal Chinese investment, with the national security review of the Chinese-backed takeover of the UK’s largest chipmaker Newport Wafer being the most notable so far. The takeover is set to be abandoned.

Tsinghua Ungroup could not be immediately reached for comment.