Rio Tinto warns of heavy $400m hit to earnings as Covid-19 hampers production

Rio Tinto has warned COVID 19-related labour shortages and rising inflation would damage its underlying earnings in the second half of 2022, as it reported misses across the board in its production output.

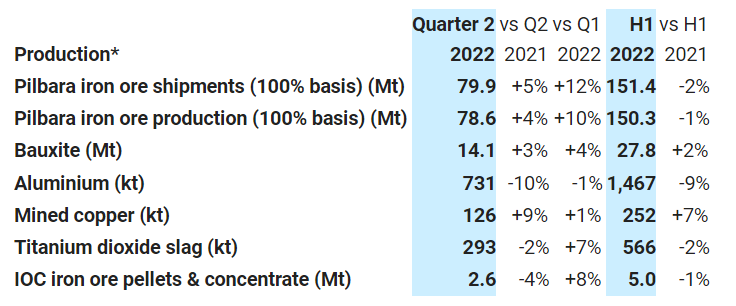

The multinational miner’s second quarter update revealed a two per cent drop in shipments of iron ore in the first half through June, alongside a one per cent drop in production.

It also suffered a nine per cent drop in aluminium production, a two per cent shortfall in titanium dioxide, and one per cent in iron ore pellets.

Meanwhile, higher rates of inflation have impacted Rio’s underlying earnings, resulting in increased pre-tax costs of about $400m in the first half of fiscal 2022, the company said.

Rio Tinto revealed rising COVID cases at its Pilbara operations have led to “elevated levels of unplanned absences”, while adverse weather conditions also played spoilsport,

The company has maintained guidance on its full-year iron ore shipments at 320-335 million tonnes (Mt) as it expects its newly opened Gudai-Darri mine in the Pilbara region to continue to raise production and reach full capacity by 2023.

This optimistic outlook contrasts with the rest of the sector, with mining companies around the world lowering annual production targets or increasing expected costs: blaming inflation, COVID lockdowns in China, recession fears and Russia’s war in Ukraine for performance problems.

For the second quarter it did reveal something a comeback in performance, as shipments rose 4.7 per cent to 79.9 Mt, narrowly missing an Royal Bank of Canada (RBC) estimate of 80.2 Mt and a UBS estimate of 80 Mt.

The results come amid global inflationary pressures and the risk of weaker demand for iron ore from top consumer China.

The country’s attempts to balance its zero-COVID strategy, meaning tough curbs on business activity and consumers, with economic growth have been weighing down on iron ore prices.

Iron ore futures have been on a downward spiral recently, tumbling below the $100 mark, as fears escalate that demand for the steelmaking ingredient in China will remain depressed in the short term.

Commenting on the update, RBC’s Ttyler Broda said: “There might be a positive read on this quarter from costs not moving higher however there isn’t too much else to get too positive on and this was only enabled by the very weak Australian dollar. The lower iron ore realised prices, higher than expected (to consensus), provisional pricing for copper and the guidance downgrades in aluminium all are likely to combine to reduce consensus estimates heading into the half year results in a week.”

Earlier this year, Rio Tinto unveiled a £12.4bn dividend for its shareholders, the second largest in the history of the London Stock Exchange.

It has also been plagued with scandal following its destruction of a sacred Aboriginal cave system last year, which sat on top of around £75m worth of high-grade iron ore.

The cave system, in the Juukan Gorge near Pilbara, had shown signs of continues human occupation for more than 46,000 years, before it was blown up.

A new leadership team was brought in after a severe backlash from shareholders, consumers and politicians, and the company commissioned an internal workplace review into its business culture.

This revealed 21 reports of actual or attempted rape in the past five years alongside widespread bullying and discrimination.

Rio Tinto will release its first-half financial results on July 27.