Rio Tinto hikes dividend after slashing costs

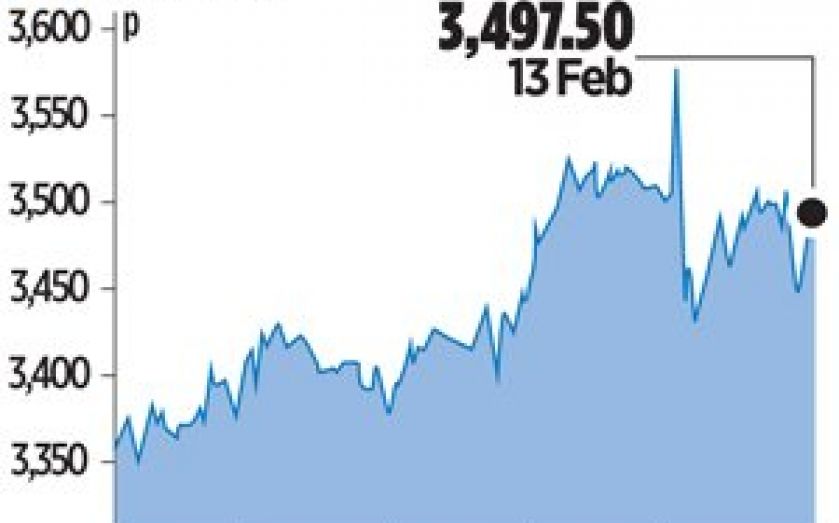

RIO TINTO chief executive Sam Walsh proved his mettle with the miner’s full-year results yesterday, which showed higher earnings and production, larger-than-expected cost savings and a 15 per cent dividend increase.

Walsh has slashed costs and divested non-core assets at the FTSE 100 Anglo-Australian firm since he took up the role a year ago, as the mining sector battles against low commodities prices in the face of a growth slowdown from China.

“These strong results reflect the progress we are making to transform our business and demonstrate how we are fulfilling our commitments to improve performance, strengthen the balance sheet and deliver greater value for shareholders,” said Walsh.

“The 15 per cent increase in our dividend reflects our confidence in the business and its attractive prospects.”

Underlying earnings rose 10 per cent to $10.2bn (£6.1bn) and cost reductions of $2.3bn exceeded the 2013 target of $2bn. Cash flows from operations rose 22 per cent to $20.1bn and capital expenditure fell 26 per cent to $12.9bn, causing net debt to fall by over $1bn to $18.1bn, beating forecasts. Debt reduction “will remain a priority in 2014,” the company said.

Iron ore continues to dominate Rio Tinto’s business, making up 83 per cent of core earnings.

Broker Investec said yesterday that the results were “ahead of expectations on all measures”.