Revolut and the race – or not – to superapp status

Two weeks ago, digital banking firm Revolut rolled out a new and rather innocuous seeming feature that allowed its users to swap messages while sending and requesting cash.

On the face of it, innocent enough: Revolut customers can now “share fun gifs and stickers” as they badger reluctant friends into coughing up wifi payments and dinner bills.

But Revolut’s chief Nikolay Storonsky was unashamed in his framing of the new tool. This was not just a messaging feature but a “step closer” to giving his users a hub to address “all their financial needs in one place”, marking a major move towards the firm’s ultimate goal of becoming a “global financial superapp”, he said.

Despite Elon Musk’s suggestions that Twitter will be morphing into an “everything app”, it is Revolut that has emerged as the frontrunner and most nakedly ambitious contender in the race to reach so-called superapp status in the West.

WeChat leads the way

The idea of a superapp largely takes its definition from East Asian behemoths that squat across the whole gamut of consumer demand, from retail to ride hailing, social media to banking. Tencent-owned Chinese digital monolith Wechat, for example, allows users to do everything from send messages to friends and buy insurance.

Malaysia-founded Grab, which started its life as a ride-hailing firm, has now spread into food delivery and payments across South East Asia, and Indonesian giant Goto has scooped up 170m customers with 20 different services from food delivery to ride hailing and payments.

Revolut, payments firm Klarna and ride-hailing app Bolt are most often touted as the runners and riders in the race to create a Western equivalent.

But even as Revolut announced today that it had sailed past the 25m user mark globally, the more crucial question is whether consumers are really ready for its sprawling superapp ambitions.

Revolut’s superapp plan

In the weeks prior to the roll-out of its chat feature, Revolut struck out on one of its most bold superapp gambits yet as it introduced Revolut Homes – a feature that would sit within its growing travel offering and essentially offer a direct competitor-product to Airbnb.

Storonsky has long been open about his ambition to achieve the status of ‘financial superapp’, under which insurance, credit and even mortgages would seem to comfortably sit. But the Homes feature raised some eyebrows in its sharp departure from Revolut’s bread and butter. And as expected, some investors are now questioning whether it is really fulfilling a user demand.

“I don’t think consumers want that,” says Dr Ricardo Schafer, a partner at venture capital firm Target Global and early investor in Revolut, in an interview with City A.M. “In the Western world I don’t see synergies between ride hailing, an insurance product and having your mortgage and your food delivery in one app necessarily.”

Although a push into new verticals may be unpalatable, he argues, consumers are certainly comfortable with the concept of an app for all their financial services needs.

“I definitely see synergies between asset management, payments, day-to-day banking – services within a specific product group,” Schafer adds.

Consumer sentiment too seems to back Schaeffer’s assessment.

Research from Paypal and PYMNTS over the summer found that 41 per cent of consumers surveyed across Germany, Australia, the US and UK would increase their banking activities if they had access to a superapp encompassing all their banking and payments needs.

But aside from the consumer demand and utility, the push to become a superapp fundamentally comes from a commercial need to boost revenue streams and bring in more cash.

In the example of Revolut Homes, David Barton-Grimley, global strategy director at fintech consultancy 11:FS argues the move essentially comes back to making itself more useful to customers with additional features and monetising their attention.

Revolut users have also already cleared its know-your-customer screening, meaning they can more easily offer products like insurance without having to jump through hoops again elsewhere in the market.

A Revolut source echoes that, telling City A.M. that now it has built a strong proposition in payments, the next logical step is to branch out into verticals, utilise its customer data and cross-sell.

Taking travel as an example, the more data the firm has on where people are spending their cash when on holiday, the better deals on hotel bookings and car rental they can offer in return. Travellers already use Revolut for cheap currency exchange, so why not homes, holiday and travel insurance as well?

Staying in your lane

Revolut’s superapp ambitions have been more wide-reaching in this regard than other company that may be mentioned in the same breath.

Bolt for instance has been cited as a superapp contender, but its offer of ride hailing, car sharing, scooter rental and food delivery might all be grouped within the same ‘mobility’ wheelhouse.

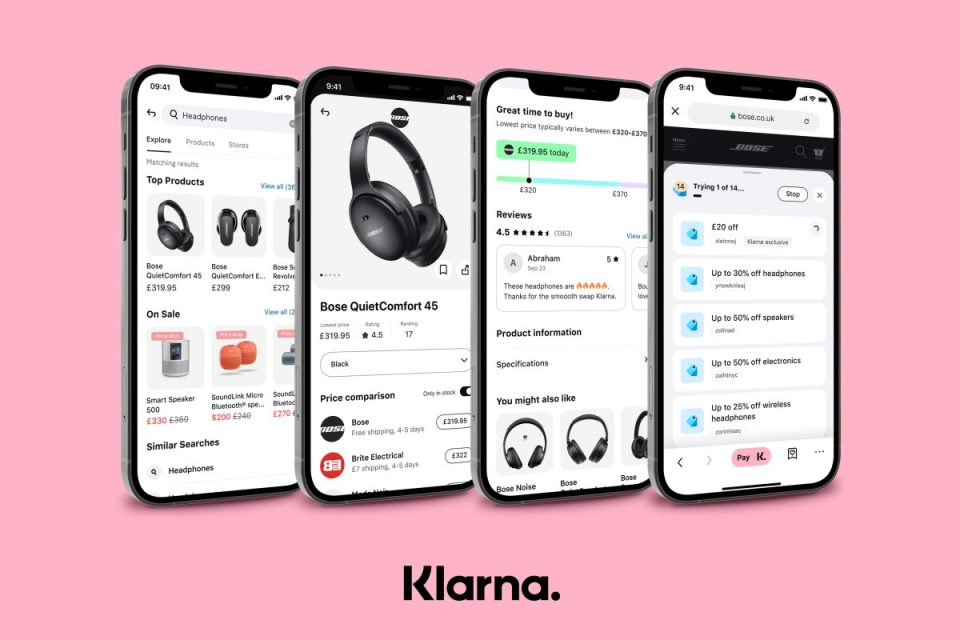

Klarna, too, while rolling out new features and leaning more heavily on its direct payments product, has stayed more or less within the retail aisle. The brand has even ramped up its move this week with a new search and compare tool to compare prices, which global CMO David Sandstrom told City A.M. is a step towards being “your assistant for each and every step of your shopping journey”.

The width of Revolut’s efforts interestingly marks a rebound from the hyper-specialisation that has defined the rise of fintech for the past decade, one in which small tech firms have divided and conquered the individual services provided by banks.

For example, payments firm Wise has honed in on remittance and creating a superior money transfer product.

But as Ian McLennan, partner at investment manager Triple Point Ventures, told City A.M., the Asian giants that spawned the concept also started from more humble, specialised beginnings.

However, the speed and proliferation of specialised fintech firms in the West over the past 15 years has led many to the conclusion that consumers are too accustomed to choice and separation.

Tim Mills, managing partner at venture capital firm ACF Investors tells City A.M. we may just enjoy messaging on Whatsapp, paying with Monzo and don’t see the need to mash them together.

“Unless you’re able to capture most of the incumbent services people already use, the value of a superapp becomes heavily diluted,” Mills argues. “Think of a shopping mall which lacks your favourite stores.”

Regulatory hurdles

A fragmented regulatory landscape in the West is only likely to hobble ambitions further.

Revolut may find itself hampered in this regard, as its efforts to win a banking licence in the UK remain unsuccessful some 18 months after application. Payments approval in all its other jurisdictions, however, mean a significant hurdle has been cleared.

Even Musk – who has already reportedly filed paperwork with US regulators that would allow him to process payments – might find his superapp mission caught in red tape before it leaves the launch pad, after Thierry Breton, the European commissioner for the internal market, quote-tweeted Musk saying: “In Europe, the bird will fly by our rules.”

For the moment , it seems that Revolut and co’s efforts to gobble up market share across the consumer spectrum may be met with some resistance. And while questions remain about the strength of demand for an everything app in the West, the superapp reality might remain some way off.