Revealed: the global league table of pension worry

Where in the world are investors most concerned about their pension savings? Schroders surveyed over 25,000 investors to find out.

Experts often warn of a growing crisis in retirement saving. A study by the World Economic Forum, for example, calculated that the total shortfall in some of the world’s largest pensions markets would grow from $70 trillion in 2015 to $400 trillion by 2050.

But what is the reality for individuals? And how do they feel about it? We asked over 25,000 investors around the world: are you saving enough money to last you throughout your retirement?

The results offer a glimpse not only of the collective view, but also how investors in different nations feel about the plans they are making for retirement.

Globally, nearly a quarter (24 per cent) of working-age investors were not convinced they were putting away enough money to last their retirement, according to the Schroders Global Investor Study 2019.

This was despite investors saying they saved 15.3 per cent on average of their income.

“It’s not a shock to find so many people are unsure if their efforts at saving will be enough,” said Sangita Chawla, Head of Retirement Savings at Schroders.

“There’s good reason – the problem is that there are so many inputs and variables that contribute to making retirement savings decisions.

“These include, but are not restricted to, deciding on what age you will retire, whether you will keep your money invested or use it to buy a product that generates an income. It will also depend on other sources of income and wealth you might have such as property.

“To make an accurate calculation, you would also need to know how long you will live, which, of course, is impossible.”

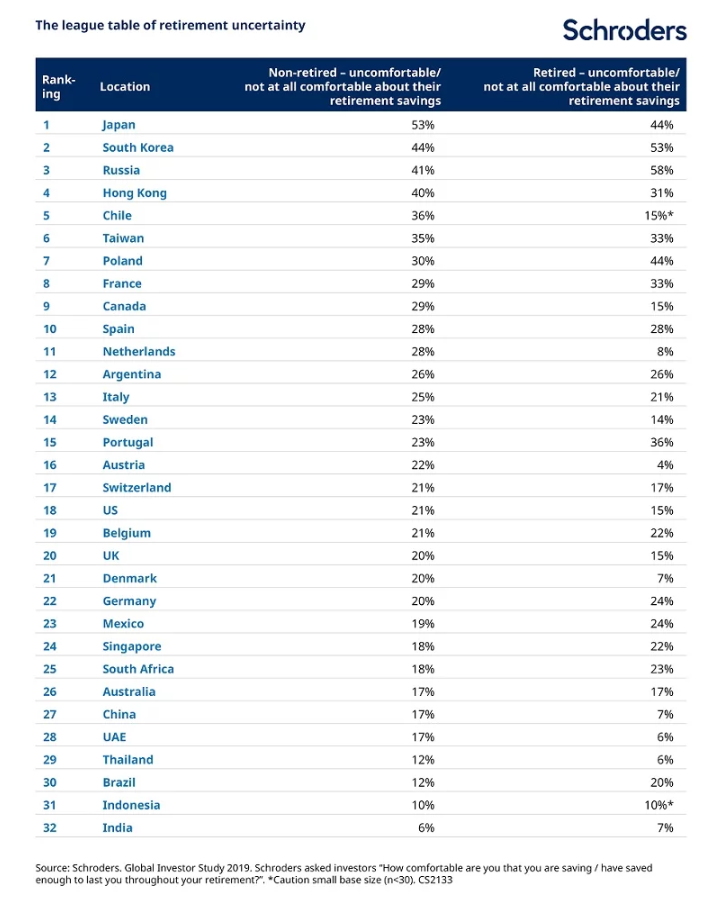

The league table of retirement uncertainty

Globally, levels of uncertainty about saving for retirement varied widely across the 32 locations where results were collected. More than half (53%) of non-retired investors in Japan were concerned.

South Korea, Russia and Hong Kong were also among the locations most concerned about their retirement savings, shown in the table below.

Four of the top ten locations were in Europe, including Poland (7th), France (8th) and the Netherlands (10th).

Investors in India, Indonesia and Brazil appeared the least worried about their retirement savings. Regionally, Asians were more concerned than Europeans about their retirement savings. Investors in the Americas were least concerned. Of course, there are outliers, for example – India and Indonesia.

Schroders’ Chawla said: “The varying levels of concerns in places around the world could be due to an array of reasons. This might include how generous state pensions may or may not be, the general outlook of investors, or the fact that people do not have a good understanding of what they will need.

“For instance, in mature markets such as Japan and South Korea returns have been poor in recent decades, while India and China have enjoyed unprecedented growth. This could affect levels of confidence and expectations for future returns.”

Source: Schroders. Global Investor Study 2019. Schroders asked investors “How comfortable are you that you are saving / have saved enough to last you throughout your retirement?”

*Caution small base size (n<30)

Retired investors were also asked if they expected their savings to last. Overall, retired investors were more optimistic with only 20 per cent expressing concern compared to 24 per cent of those still working and saving.

However, the data suggests there may be the potential for shocks in some countries where the level of concern rose notably between those still working and those retired.

The disparity, where retired people had a higher proportion of those feeling uncomfortable than those non-retired, was widest in Russia, Poland, Portugal, South Korea and Brazil. Russia had the most notable rise in unease, stepping up from 41 per cent among working investors to 58 per cent for those retired.

Read more from the Global Investor Study 2019:

– How much could you withdraw from your pension pot?

– What do you expect your investments to return over the next five years?

– The fund industry’s wake-up call: how investors want us to act

Conversely, there were locations where working-age investors were overly worried.

For instance, in the Netherlands, Austria, Canada, Denmark, China and UAE retired investors were far more comfortable with their retirement savings than their working counterparts.

In Austria, for example, 22 per cent of investors were uncomfortable about their retirement savings but only 4 per cent of retired investors expressed unease.

Chawla added: “If investors feel uneasy, they should seek help from an independent financial adviser or planner. Decisions about retirement saving are difficult given the many factors at play. The support of an expert can help give people confidence that they have made the right decisions.”

- To discover more about the Global Investor Study 2019 visit schroders.com/gis

In April 2019, Schroders commissioned Research Plus Ltd. to conduct an independent online survey of 25,743 people who invest in 32 locations around the world, including Germany, Australia, Brazil, Canada, China, Spain, the United States, France, India, Italy, Japan, the Netherlands and the United Kingdom. This research defines “investors” as those that will invest at least 10,000 euros (or its equivalent) in the next 12 months and that have made changes in their investments in the last 10 years.

Important information

This communication is marketing material. The views and opinions contained herein are those of the named author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds.

This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroder Investment Management Ltd (Schroders) does not warrant its completeness or accuracy.

The data has been sourced by Schroders and should be independently verified before further publication or use. No responsibility can be accepted for error of fact or opinion. This does not exclude or restrict any duty or liability that Schroders has to its customers under the Financial Services and Markets Act 2000 (as amended from time to time) or any other regulatory system. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions.

Past Performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall.

Any sectors, securities, regions or countries shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

The forecasts included should not be relied upon, are not guaranteed and are provided only as at the date of issue. Our forecasts are based on our own assumptions which may change. Forecasts and assumptions may be affected by external economic or other factors.

Issued by Schroder Unit Trusts Limited, 1 London Wall Place, London EC2Y 5AU. Registered Number 4191730 England. Authorised and regulated by the Financial Conduct Authority.