Revealed: How have audit industry rankings changed in 15 years?

From success stories to hours of struggle, the audit market and its key players have changed considerably in the last decade and half.

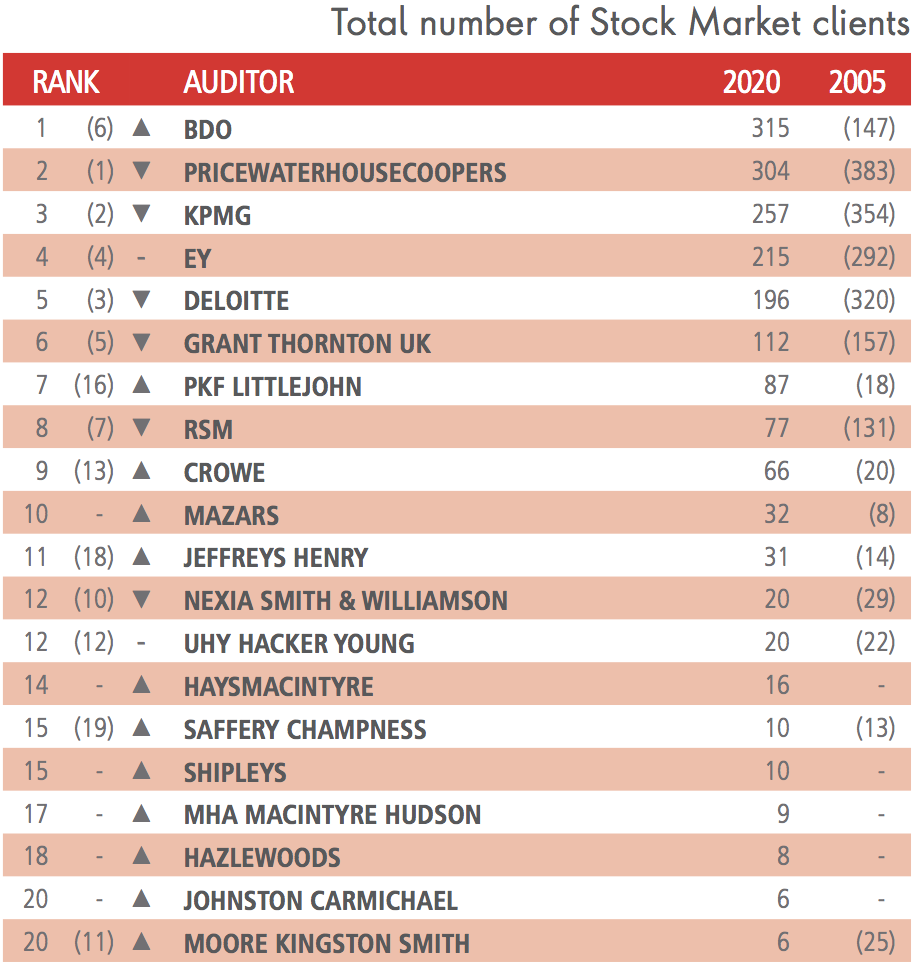

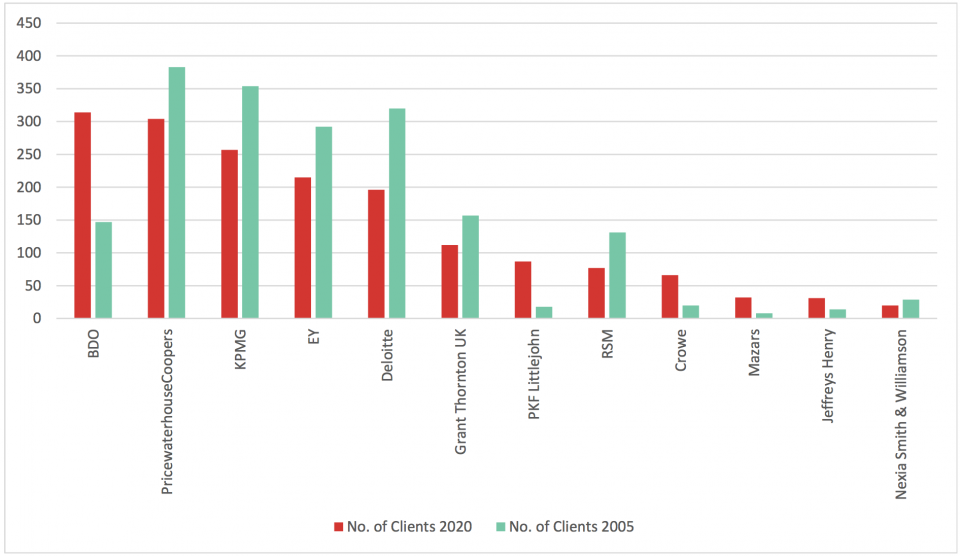

Challenger firm BDO has been the standout success story of the past 15 years, doubling its client count to 314 and snatching first place for number of clients away from Big Four giant PwC, according to the Corporate Advisers Rankings Guide, which publishes the latest sector rankings annually.

Back in 2005, when the guide was first put together, BDO was ranked sixth among auditors by client numbers, but has since moved to the top of the table. The challenger firm counts the likes of AJ Bell, Playtech and Oxford Instruments among its FTSE 250 clients.

Though BDO has broadened its client share, it continues to be shut out of auditing FTSE 100 firms, an area dominated by the Big Four.

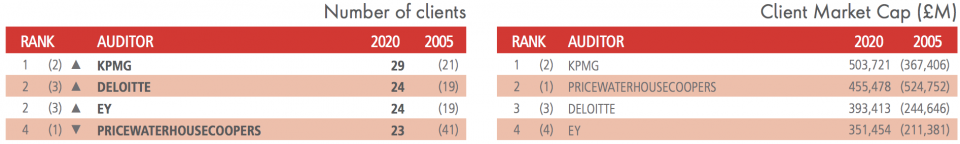

Within the last 15 years there has been some jostling among the Big Four when it comes to FTSE 100 dominance, although each of the major auditors now work with a similar number of FTSE 100 clients.

Back in 2005 PwC held the top spot for number of FTSE 100 clients, auditing 41 FTSE 100 firms. Since then the firm has fallen to last place among the major firms, auditing 23 clients from the FTSE 100.

Despite the audit giant’s fall from top spot among FTSE 100 firms, PwC has the greatest overall total market cap of stock market clients, followed by fellow Big Four firm KPMG.

PwC historically had the largest FTSE 100 audit market share by some distance as a result of the merger between PwC & Lybrand in 1998.

Mandatory firm rotation, introduced in 2016, has played a role in rebalancing the audit market share among the Big Four.

Hemione Hudson, head of audit at PwC, said: “The changing market share reflects healthy competition for audits and the changing constituency of the FTSE 100. For PwC, audit quality has to be the top priority.”

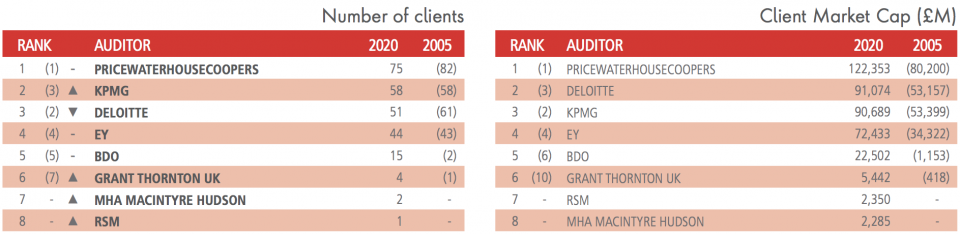

For clients in the FTSE 250, PwC has both the greatest number and the largest client market cap, followed by KPMG and Deloitte. Deloitte has seven fewer FTSE 250 clients than KPMG, but KPMG commands a larger client market cap.

Clients in the FTSE 350 paint a very similar picture.