Strong January retail sales raise hopes UK already ‘moving out of recession’

Retail sales rebounded much more than expected in January, following a poor Christmas period, raising hopes that the UK economy will be able to escape recession within a matter of months.

Figures from the Office for National Statistics (ONS) showed that sales volumes were up 3.4 per cent in January, compared to the 1.5 per cent expansion expected by economists.

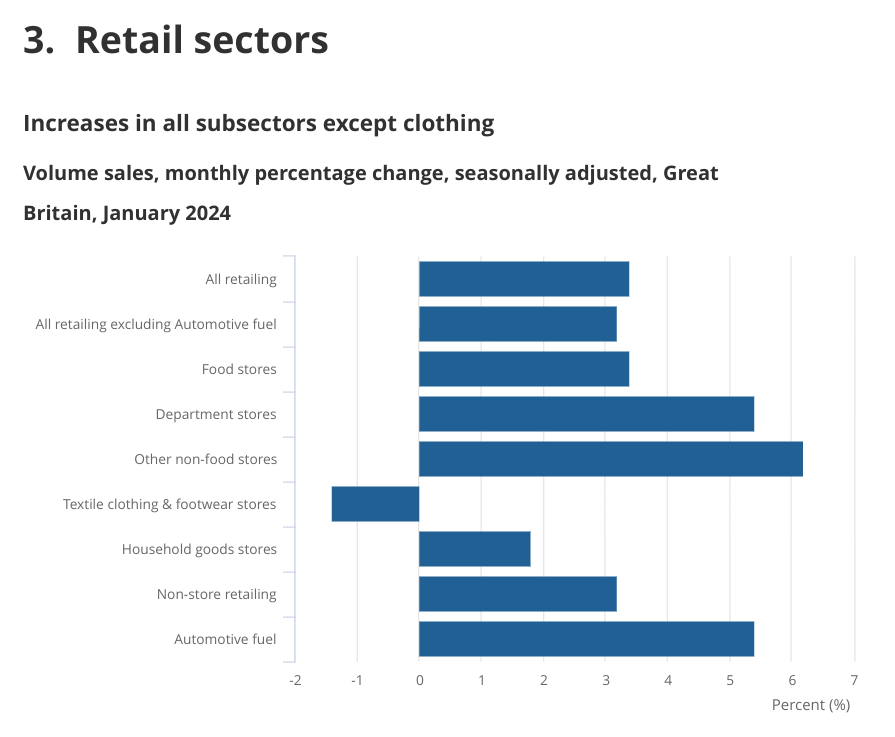

The ONS noted this was “the largest monthly rise since April 2021 and returned volumes to November 2023 levels”. Sales in all sectors excepted clothing saw expansion, with food stores leading the way.

“Household goods stores, sports shops and department store retailers were amongst those reporting robust trading due to January sales promotions,” Heather Bovill, deputy director for surveys and economic indicators at the ONS, said.

The figures offset disappointing sales volumes from December, when heavy discounting around Black Friday brought forward Christmas sales into November. However, the ONS also noted that nearly half of surveyed adults said they would spend less over Christmas due to the rising cost of living.

Looking across the previous three months, sales volumes fell by 0.2 per cent in the three months to January compared to the previous three months. This was the smallest quarterly fall since August 2023.

The ONS noted that consumers “spent more for less” in January with the rise in sales values exceeding sales volumes.

This morning’s figures retail sales data round off a busy week of data for the UK, in which investors have received updates on the labour market, inflation and GDP. Data out yesterday confirmed that the UK fell into a recession in the second half of last year.

GDP fell 0.3 per cent in the final quarter of the year, a worse performance than economists had expected after output was revised down in both October and November.

However, economists think that the outlook is improving for the UK as falling inflation gives struggling consumers a boost in disposable income.

Lower inflation has also raised the prospect that the Bank of England will start cutting interest rates in the first half of this year, which will ease pressure on struggling households and businesses.

Commenting on the figures, Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said there are “signs of a consumer-led recovery taking hold”.

Some economists even argued that the figures suggest the UK is already out of a recession. Joe Maher, assistant economist at Capital Economics, said the figures “put an end to the retail recession and perhaps even the wider economy recession”.

“Today’s release was stronger than expected and suggests the drag from higher interest rates on consumer spending is fading fast and points to the economy soon moving out of recession,” he continued.