Sharp increase in retail sales amid ‘subdued’ outlook due to inflation – but is there a ‘chink of light’ with Easter holidays?

British retail sales grew sharply last month compared to pre-pandemic levels, but price increases continue to deliver a “subdued” longer-term outlook.

Sales volumes are thought to have increased by 1.2 per cent in February after a rise of 0.9 per cent in January, suggesting the industry is recovering from the pandemic well.

Industry figures are however looking ahead to the forthcoming Easter holidays, with an expected uptick in retail sales.

The warmer weather is also likely to bring more Brits out to pubs, bars and restaurants, supporting the hospitality industry, while news of the end of strike action disputes is set to help the industry further.

This week, high street retailers breathed a sigh of relief after the rail union RMT called off industrial action, which was set to cripple the capital again later this month, and next.

In figures released by the Office for National Statistics today, it showed however that compared to the same period last year, February’s retail purchases were actually down by 3.5 per cent, suggesting a slower rate of growth than first thought.

This comes as the cost of living crisis continues to pinch Brits’ spending power, with this week’s shock rise in inflation to 10.4 per cent helping to secure an 11th consecutive interest rate increase.

It was also reported that 11 out of 14 sectors monitored by Lloyds Bank had powered away from recession this week.

With inflation continuing to hit consumers’ disposable income and retailers costs, pushing up prices, many are putting off spending on luxuries, cancelling subscriptions and looking for cheaper alternatives to their weekly spending routines.

ONS figures show that while spending increased in February, on a broader level, they fell 0.3 per cent in the three months leading up to it, including the Christmas period.

What Brits are spending their cash on?

Non food sales volumes, such as clothes, rose by 2.4 per cent after strong discount department store sales. Meanwhile, food store volumes also rose by 0.9 per cent last month, after a 0.1 per cent increase in January.

According to ONS, there is some anecdotal evidence of reduced spending in restaurant and takeaways due to the cost of living crisis.

There was however good news, with Britain’s oldest brewer Shepherd Neame reporting an increase in profit this week, despite the cost of living crisis.

However, multiple supermarkets have been slashing their prices in a bid to keep costs down for Brits during the cost of living crisis. This week, Morrisons was the latest to do so.

This week it was reported by both Budweiser and tonic maker Fever-Tree raised their prices had to be increased due to higher costs, owing to inflation.

This morning, Tim Martin’s JD Wetherspon reported its profit was down a staggering 91 per cent, as he blamed the “ferocious” impact of inflation.

Brits are also moving away from pandemic-induced DIY with both Kingfisher and Wickes reporting declining profit this week, as millions tighten their belts.

Online sales were perhaps the biggest casualty, rising by just 0.2 per cent compared to 2.9 per cent in January, while car petrol and diesel sales were up 1.1. per cent, with rail strikes thought to have increased use of automobiles.

ONS Director of Economic Statistics Darren Morgan said that “retail grew sharply in February with sales returning to their pre-pandemic level.

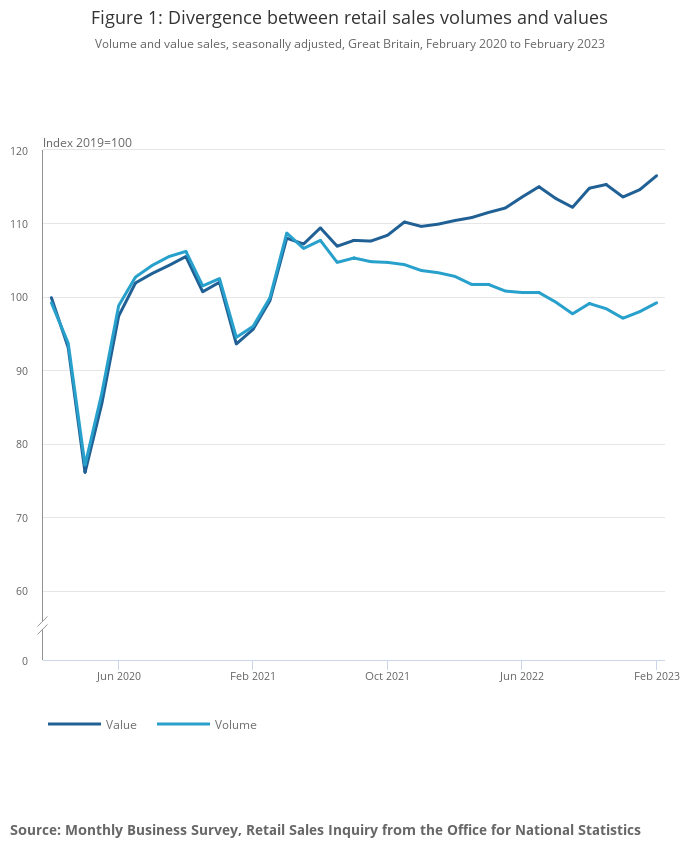

“However, the broader picture remains more subdued, with retail sales showing little real growth, particularly over the last eighteen months with price rises hitting consumer spending power.

“In the latest month, discount department stores performed strongly with food shops also doing well as consumers, confronted with cost-of-living pressures, cut back on eating out or purchasing takeaways.

“After rail strikes increased car travel in January, fuel sales fell back in February.”

Is the retail sector concerned? Yes and no.

Following February’s sharp increase in retail sales volumes, industry leaders reacted with caution due to rising inflation

Helen Dickinson, chief Executive of the British Retail Consortium, said that while “retail sales growth accelerated to 6.3 per cent, its highest level since March 2022.. rising inflation meant that sales volumes remained firmly in the red.

“Despite the ongoing cost of living squeeze, consumers were still ready to spend on what they needed, with higher sales for categories including clothing and cosmetics.

|There remain challenges to consumer spending in the coming months with the end of the Energy Bill Support Scheme in April and the increasing cost of borrowing. It is essential that Government avoids any additional regulatory burdens on business that would risk pushing prices up, adding to the squeeze on consumer wallets.”

Meanwhile, Jacqui Baker, head of retail at RSM UK and chair of ICAEW’s Retail Group, reflected on the improving of consumer confidence which is “continuing to creep up from a September low”.

“These figures reflect people coming out of the January hibernation” but February’s figures show “shoppers are still having to make stark choices in their spending habits as consumer confidence is well below normal levels and a lot of uncertainty remains.

“They are spending but consumers are making the choice to trade down to make their money go further, as shown by the strong sales at discount stores. Purchases are much more considered, with household goods bearing the brunt of this, down 0.3 per cent, which is unsurprising giving the weaker housing market.

She added that retailers will now “look forward on their sales calendar, consumers will be wanting to enjoy the longer days, with Easter and three bank holidays in May there’s a chink of light to boost sales”.

Also weighing in on the figures was , Gizem Günday, a partner at McKinsey & Company, who said the increase in food sales will be a relief “given the impact of fruit and vegetable shortages throughout the month.

“However, the overall sales growth is still driven by high prices. As this growth is predominantly inflation-driven, it will be likely eroding retailers’ profit margins.

Farah Thalji, a senior director at global consultancy Simon-Kucher & Partners, added that “today’s numbers are hardly surprising” following the inflation shock midweek.

“Even as February’s retail volumes have crept back up to 2020 levels in the same month, inflation remains stubbornly high, which is dampening consumer appetite and buying power, especially with regard to higher food and drink prices in supermarkets and also in pubs and restaurants.”