Retail sales fall off cliff in November in sign of Christmas spending slump

Retail sales have fallen off a cliff, pushed by consumers reining in spending as scorching inflation eats away at their finances, a new survey out today reveals.

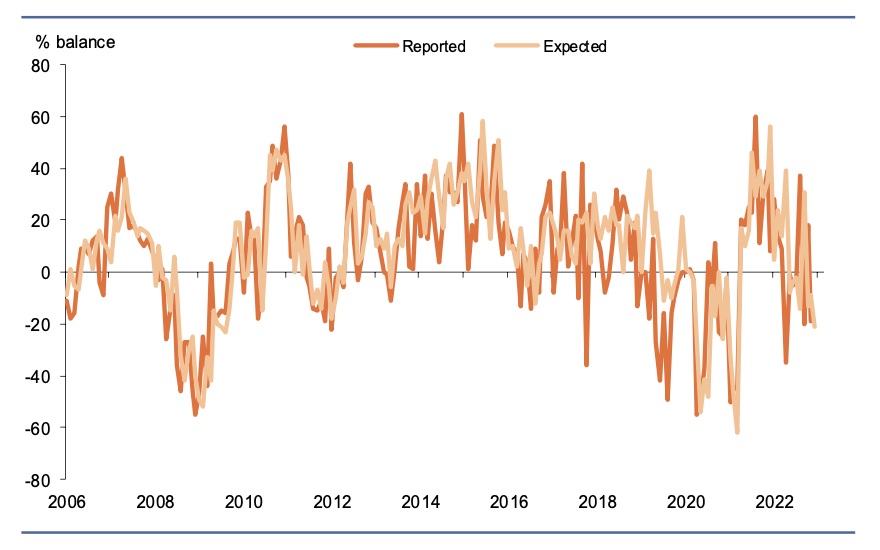

A net 19 per cent of retailers said spending fell over the year to November, down from a net rise of 18 per cent in October, according to the Confederation of British Industry (CBI), the country’s largest business group.

The drop did not capture last week’s Black Friday sales, which are likely to have boosted this month’s figure. Data from Nationwide and Barclaycard revealed consumers continued to take advantage of deals despite the cost of living squeeze.

Nonetheless, Brits are clearly cutting discretionary spending in a bid to protect their budgets so they can afford basic necessities. Office for National Statistics numbers also show retail sales softening.

Prices are up 11.1 per cent over the last year, the fastest acceleration in 41 years and wiping out historically high pay growth.

Retail sales fell sharply this month

Martin Sartorius, principal economist at the CBI, said: “It’s not surprising that retailers are feeling the chill as the UK continues to be buffeted by economic headwinds.”

“Sales volumes fell at a firm pace in the year to November, and retailers remain notably downbeat about their future business prospects,” he added.

A net 21 per cent of high street firms expect sales to shrink during the Christmas period, when shoppers typically splash the cash.

Retailers rely heavily on the final quarter of the year to tip them into profitability. A spending slowdown risks squeezing already thin margins in the sector, possibly ticking up insolvencies.

Furniture retailer Made.com has already fallen into administration.

Employment prospects are souring in the sector as company bosses brace for a slump in demand during the coming recession.

The CBI said employment dipped, with a net 17 per cent of retailers in the year to November reporting shrinking their staff, down from a net rise of 13 per cent in August. It is the first decline in head count since August 2021.

Businesses are not just suffering from a drop in demand. Swelling energy costs sparked by Russia’s invasion of Ukraine jolting international energy markets are squeezing margins.

A historic inflation surge has forced the Bank of England into eight successive interest rate hikes, taking them to three per cent, the highest level since 2009, making it much more costly for businesses to borrow to fund day-to-day spending.