Relief at CAT Abbott deal

Cambridge Antibody Technology (CAT) has reached an agreement with American pharmaceutical firm Abbott about how much it should get in royalties from the sale of the blockbuster arthritis drug Humira.

The deal, which sent shares in the loss-making British biopharmaceutical company up almost 4 per cent, has headed off a Court of Appeal’s case scheduled for this week.

In a complex agreement, Abbott will pay a reduced royalty of 2.688 per cent from the 3.1 per cent CAT received on sales of the drug from January next year. As part of the deal, CAT will receive a one-off payment of $255m (£144m) to pay off its licensors.

Abbott and CAT discovered Humira jointly, but CAT sold most of its rights at an early stage of the drug’s development. As a result, it received a small proportion of the profits from the sale of the drug, which is expected to generate revenues of $1.5bn this year.

The company has been in dispute with Abbott over royalties since 2003. Abbott won the first round last November, but the settlement has come as welcome surprise, as it guarantees revenues from the sale of Humira, and avoids a drawn-out appeal process.

Sam Williams of Lehman Brothers said: “Although we were confident Abbott would lose its appeal, we thought there was a 20 per cent chance of them winning.”

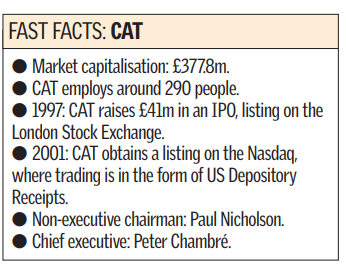

Chairman of CAT Paul Nicholson said: “We can now concentrate fully on CAT’s business going forward.” Abbott president Jeffrey Leiden added he was pleased to find a solution that benefited both companies.

Humira, an injectable drug, mimics antibodies normally found in the body and works by blocking tumour necrosis factor-alpha, a human protein involved in the development of the disease.

Earlier this month, America approved Humira as a treatment of psoriatic arthritis, as well as rheumatoid arthritis.