Red Sea crisis sees Europe import decade-high US diesel oil volumes

European diesel oil imports from the US Gulf have reached their highest point in seven years and the second highest mark of all time as problems in the Red Sea continue to impact global trade.

Data from global intelligence firm Kpler shared with City A.M shows that 283,000 metric tonnes of diesel made the journey to Europe from the US Gulf in the month of January, apoint last reached in August 2017.

The January figure which represents a 375 per cent leap on October 2023 levels shortly before attacks from Houthi rebels on Israeli ships began in response to the latter’s war with Palestine.

Simultaneously, oil product arrivals from Saudi Arabia, India and Kuwait tumbled by 15, 31 and 43 per cent in the period between January 1st and 17th against figures from December.

As such, the US is now the leading supplier of crude oil, liquefied natural gas and diesel to the European markets.

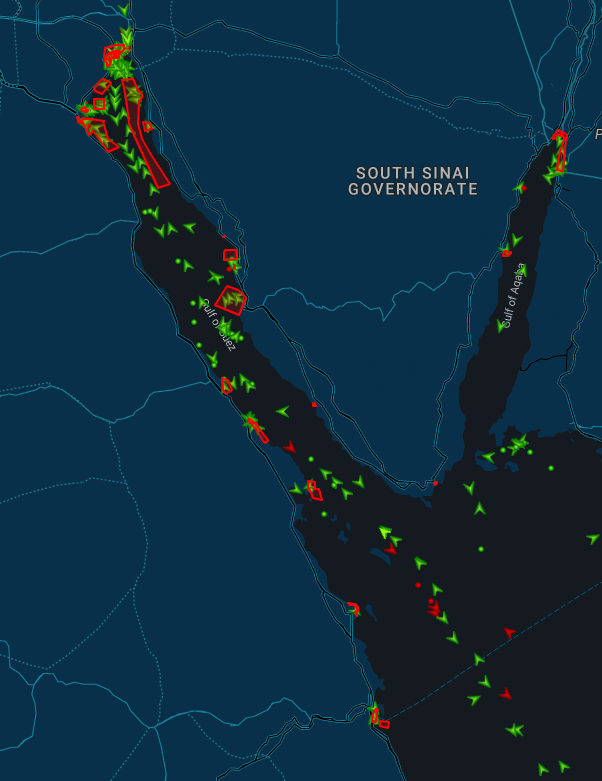

According to S&P Global Insights, Europe typically sources around one-third of its diesel supply from the Middle East but journeys are currently taking around 45-50 days thanks to re-routes around the Cape of Good Hope.

Journeys from the US coast, by contrast, take around 20-25 days to deliver the cargo to North West Europe.

“That was once the duration of a delivery from India or the Middle East too back when the Suez Canal was still fashionable,” Kpler’s lead analyst, Viktor Katona told City A.M.

“But Kuwaiti diesel now takes around 42-43 days, sometimes longer,” he added.

The Suez Canal, for years one of the world’s busiest arterial trading routes, has recently fallen to the lowest traffic levels since the 2021 blockage as a direct result of the Red Sea attacks.

One potential cause for concern on the continent is the looming date of maintenance season in the US, a 45-day period at some point in Q1 when repairs are carried out across oil and gas projects.

US output tightens and stock levels are relied upon as a result, which could constrict Europe’s supplies.