Recovery may be start of boom bust cycle says Berenberg

The UK recovery is showing disturbing signs of mirroring the pre-crash economy, fuelled by consumer spending and easy credit, according to a Berenberg research note.

The bank draws attention to the worryingly low savings rates in the UK which are being further depleted, giving some temporary boost to the economy. A similar situation prevailed in the decade to 2010 which saw the lowest saving rate since before 1955. Government interventions into areas such as the housing market may also be paving the way for another financial crisis.

Rob Wood, chief UK economist:

The schemes that selectively boost the housing market – like the government’s huge mortgage guarantee scheme – are a risk too far. They should be scrapped to lessen the chance that trying to nurture the real economy back to health ends up setting off a dangerous boom-bust cycle in the property market.

The bank has been surprised by how far savings have fallen this year. This has been particularly acute in recent months and Berenberg expects the desire to save to continue to fall in coming months. The decline comes in the wake of the Bank of England's introduction of forward guidance and positive economic data.

The rise in house prices of six per cent and mortgage approvals of 34 per cent year on year, is a sign that consumers are increasingly confident about the availability of cheap credit. The market has risen dramatically over the past few months with the Royal Institution of Chartered Surveyors survey hitting its highest level since 2002 in September.

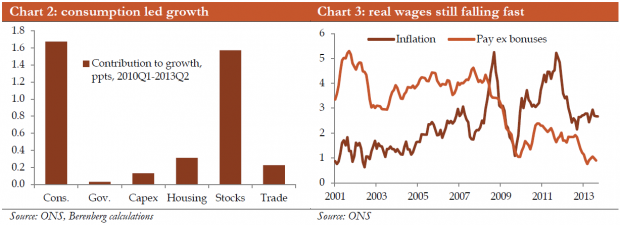

Berenberg forecasts that trade will likely contribute only marginally to growth, and business investment will improve only gradually. Households still have a lot of debt on their balance sheet yet this has not prevented them from taking on credit and bidding up house prices.

However consumers buying house prices at inflated prices will leave them at risk from price falls in future. Increasing UK leverage is leaving little room to respond if there is a domestic or international shock. Raising interest rates will also become far more difficult.

The missing factor in the UK recovery is investment. However there are some reasons to be hopeful. Eurozone confidence is improving and growth is returning. There is a good chance that the recovery will become a virtuous circle of rising productivity, wages and investment will give the recovery a firmer foundation.