Recovery

Bitcoin is booming

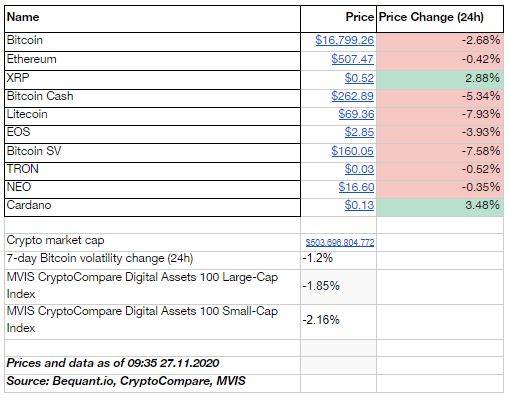

Bitcoin staged a healthy pull back in the wake of a dramatic collapse in spot price from the mid-$19,000 all the way into the low $16,000 area. By early Friday, Bitcoin was looking to reclaim the $17,000 level once again and while the aforementioned shake out did raise fears of a more extended pull back, dip buying is expected to resurface once market participants deal with the expiration of derivatives.

Of note, heading into the final days of the month, Bitcoin is trading up 23% month-to-date (MTD) and 134% year-to-date (YTD), while Ethereum is up 28% MTD and 290% YTD.

In the Markets

Uni or Sushi?

Looking at broader indices performance YTD and large caps MVIS index is up 125%, while small-caps index is up 35%. That is in spite of trading more or less lockstep right until September.

As a reminder, September marks the infamous DEX trading volume spike and SushiSwap drama. More recently, SushiSwap was again able to attract liquidity away from Uniswap upon the completion of farming rounds on Uniswap. Also, just this morning it was picked up that DeFi favourite developer Andre Cronje is allegedly staking over $800k worth of SUSHI.

Crypto AM: Longer Reads

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking in association with with Zumo

Crypto AM: Talking Legal in association with INX

Crypto AM: Inside Blockchain with Troy Norcross

Crypto AM: Definitively DeFi

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM shines its Spotlight on OneCycle