‘Recovered from doldrums’: UK manufacturing returns to growth for first time since July 2022

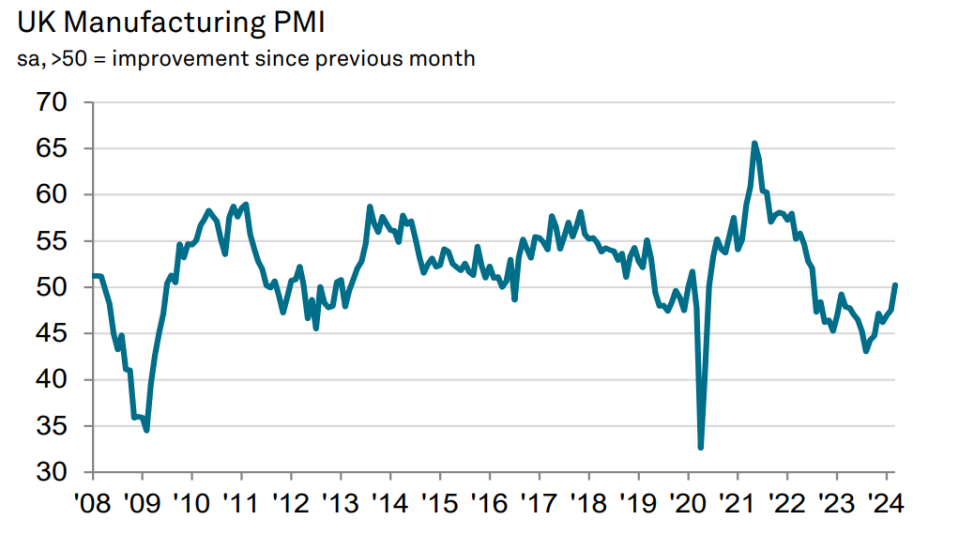

The UK’s manufacturing sector recorded growth for the first time since July 2022, according to a closely watched survey, as the long downturn in the sector appears to be coming to an end.

S&P’s purchasing managers’ index (PMI) for the manufacturing sector showed a reading of 50.3 in March, up from 47.5 in February and higher than the earlier ‘flash’ estimate of 49.9.

PMIs measures activity in the private sector. The 50 mark separates growth from contraction.

Output and new orders for manufacturing firms increased for the first time in a year helping business optimism about the year ahead to hit an 11-month high.

“The long downturn in manufacturing output is over according to the PMI,” Rob Wood, chief UK economist at Pantheon Macroeconomics said.

“This isn’t just a flash in the pan, with the forward-looking indications from the PMI suggesting growth will improve further,” he continued.

The survey showed that output growth was concentrated in consumer goods, helping to offset continued weakness in the investment goods category.

“Where an expansion of production volumes was registered, this was linked to client restocking supporting a rise in new order intakes,” the survey noted.

Rob Dobson, Director at S&P Global Market Intelligence, said the sector had “recovered from its recent doldrums” in the first quarter of the year.

“Production and new orders returned to growth, albeit only hesitantly, following yearlong downturns, with the main thrust of the expansion coming from stronger domestic demand,” Dobson said.

Reflecting higher levels of confidence and stronger demand, there were also signs that employment levels were stabilising too with the pace of job loss easing to its slowest since last May.

However, there were still signs of weakness for the sector. Although domestic demand showed signs of picking up, exports remained weak with overseas demand falling for the 26th consecutive month.

Companies reported reduced demand from mainland Europe, with specific reference to France, the Netherlands, Belgium and Poland.

The crisis in the Red Sea also contributed to extended delivery times as global shipping continues to be diverting away from the troubled waterway.

“Potential blockers remain such as continued weak export performance and supply chain stresses, with the neighbouring EU market the main drag on overseas demand and the Red Sea crisis still impacting supply chains,” Dobson said.