Record winter heat across Europe drives down gas prices

Record temperatures across Europe in the first few days of this year has seen gas prices plummet, easing blackout fears across the continent.

At least seven European countries enjoyed their warmest January days on record on New Year’s Day, according to climatologist Maximiliano Herrera.

Belarus, Denmark, Czech Republic, Latvia, Lithuania, the Netherlands, and Poland all saw temperatures typically seen in the spring.

Poland saw a peak temperature of 19C, where the normal temperature for this time of year is just above freezing at 1C.

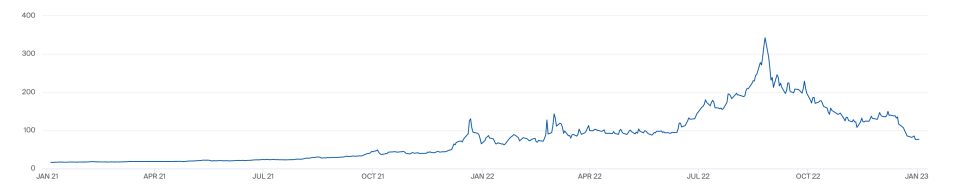

This has led European gas prices to drop 4.8 per cent on the key Dutch TTF Futures benchmark this afternoon, with gas now trading at €77 per megawatt hour (MWh)

For context, it was trading at a record high of €343 per MWh in August, while historically it normally does business at around €18 per MwH.

UK gas prices also dropped following warmer conditions on January 1, with temperatures north of 10C across much of the country. The UK futures market is down nearly nine per cent, where the smaller benchmark is more prone to volatility.

Ole Hansen, head of commodity strategy Saxo Bank, told City A.M. that this warmer weather has been “the main reason” for falling gas prices in the UK and Europe because it has reduced demand.

He also noted that high temperatures in Asia were driving down gas prices alongside the unseasonal heat in Europe.

The energy expert said: “Strong winds driven by the warm weather have lifted power generation from renewables while demand from Asia remains subdued due to mild weather there together with the current virus outbreak in China reducing activity. On top of all this, demand has also softened as economic activity slows and consumers try to reduce their energy bills through lower demand.”

Hansen added that Europe was now in a much stronger position for the start of this year, compared to the gloomy expectations of blackouts and power shortages this winter.

Hansen explained: “At the start of 2023, the gas storage system across Europe currently holds 337 TWh more than the same time last year. Considering only 295 TWh was withdrawn during the first quarter last year, it is safe to assume given the slowdown in demand that Europe will exit this winter with ample supply.”

The commodity specialist believed this put winter prices for 2023/24 price under pressure, with the TTF contract covering the October 2023 to March 2024 period currently trading around €84, less than 10 euros above the current spot price.

Headwinds remain to drive up gas prices

The influence of the warmer weather in driving down prices was highlighted by other analysts including Nathan Piper, head of oil and gas research at Investec.

But he also noted that with the weather having such a strong influence over prices, a cold snap could easily drive up markets again.

Piper said: “In contrast to extreme winter conditions across North America, the UK and Europe has enjoyed a period of seasonally mild and windy conditions across the festive period. This combination while industrial activity is also reduced resulted in much lower gas demand and prices. However prices remain high by historic levels and we anticipate further volatility if colder conditions return.”

Looking ahead to other potential factors that could drive up prices, OANDA’s senior market analyst Craig Erlam argued that further cuts from Russia and rebounding demand in China could squeeze markets again.

“A lot could and probably will change in the interim, most notably the remaining supply coming from Russia. In the eyes on many, it’s not a case of if that will be cut as well but when. That will impact how vulnerable Europe is next year,” Erlam said.

“But China is also a big factor as a strong economic rebound in the event of a successful navigation away from zero-Covid to zero restrictions will fuel demand and drive up prices for Europe and others. Its Covid strategy last year turned out to be a blessing in disguise for Europe as the situation could have otherwise been much worse,” he added.