Record profit warnings

The number of British companies issuing profit warnings in September surged to a four-year record due to difficult market and trading conditions.

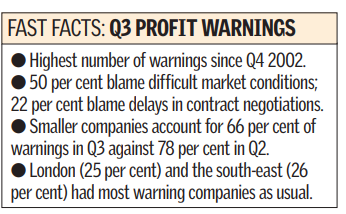

According to research by Ernst & Young, 103 firms listed on the London Stock Exchange issued a warning in the three months to 30 September. This represents a rise of 39 per cent compared with the same period last year. Of those, 46 were issued last month — the most warnings in one month since November 2001. The year to 30 September brought 370 warnings, up 42 per cent on the previous year.

Keith McGregor, corporate restructuring partner at Ernst & Young, said: “Businesses should be able to control and forecast their cost base and this suggests that UK plc has still yet to grasp the importance of rigorous business planning.”

Those who suffered most from profit warnings were in media and entertainment, construction, support services, electronic goods, and software and computer services. Despite the well-publicised retail slump, only five general retailers issued warnings in the quarter, 50 per cent fewer than last year.

Head of corporate restructuring Andrew Wollaston said: “The lower warnings is evidence that the continuing bad news has started to affect confidence to the point that boards of retail companies are no longer prepared to sign off aggressive forecasts.”

The research also shows that companies issuing a warning during the third quarter saw their share price drop by an average of 13 per cent in next-day trading, a level which has been broadly consistent over the past year.