Recession risks return as Brits brace for cost of living crisis to make 2023 a ‘bumpy ride’

UK consumer confidence dipped for the first time in two months in January, raising the risk the economy will slip into recession after all despite a string of better than expected data recently, a closely watched survey out today reveals.

A credit card debt hangover from the Christmas spending splurge and energy bills looming has knocked Brits’ optimism.

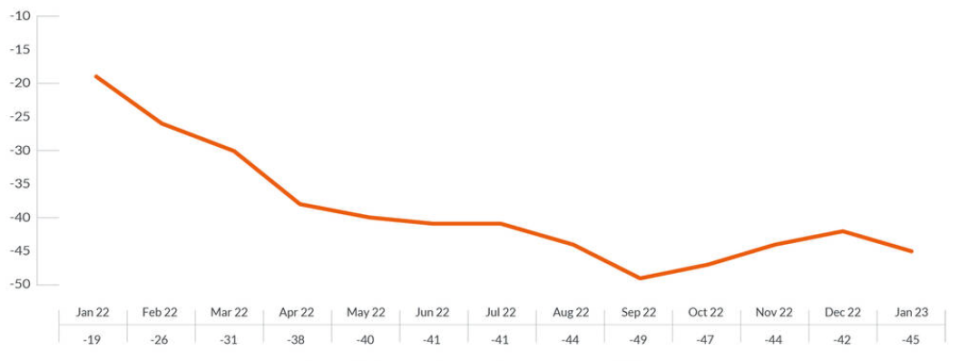

GfK’s long-running consumer confidence index dropped to minus 45 points this month, down from minus 42, the firm said today, arresting a brief rise in optimism after it collapsed to a record low after Liz Truss’s calamitous mini-budget.

Households are sobering up to the possibility of their finances being knocked by the UK’s flatlining economy, experts said.

“Consumers have a New Year hangover – but it’s of the economic kind – with high levels of pessimism over the state of the wider economy. And unlike a conventional hangover, this one won’t vanish quickly,” Joe Staton, client strategy director at GfK, said.

“The forecast for consumer confidence this year is not looking good. One thing we can be sure of is that 2023 promises to be a bumpy ride,” he added.

Declining confidence could deal a blow to newfound optimism over the underlying health of the UK economy sparked by a few positive figures out over the last week.

Consumer confidence has plummeted

The shock bump means the economy would have to shrink by at least 0.4 per cent in December for the country to meet the official recession definition of two consecutive quarters of contraction after declining over the summer.

Although still running at a 40-year high, inflation is expected to halve by the end of this year.

However, the cost of essential items such as food and energy has risen sharply, heaping pressure on household budgets. Food price inflation nearly hit 17 per cent in December, a multi-decade high.

Energy bills have skyrocketed over the last year due to Russia’s invasion of Ukraine, forcing the government to cap them at £2,500 to prevent a living standards catastrophe. The cap will jump to £3,000 in April, squeezing budgets.

“Higher essential costs, a fear of further increases yet to come, particularly the April energy price cap rise, are weighing on consumer confidence,” Linda Ellett, UK head of consumer markets, retail and leisure at KPMG, said.

All but one of GfK’s finance indicators fell last month, including its major purchase index, by six points, suggesting consumers are retreating from buying homes and other items that eat up a huge chunk of their finances.

The Bank of England has lifted interest rates nine times in a row to 3.5 per cent, a post-pandemic high, to tame inflation, making it much more expensive for people to borrow cash to finance big purchases.

However, households are more confident that their personal financial situation will improve over the next year, possibly driven by economists forecasting inflation will gradually fall in 2023.

The Bank reckons the rate of price increases is on course to drop to around five per cent by the end of the year, although that would still be more than double its two per cent target.

Forecasters at Investec and Cornwall Insights think the average annual energy bill will fall below the government’s uprated £3,000 cap by the summer, relieving some of the strain on household finances.