Recession risks loom as UK’s service sector falls into negative territory

The UK’s all-important service sector fell into contraction in August, the first pullback since January, as the economy felt the impact of higher interest rates and the risks of a recession grow ever larger.

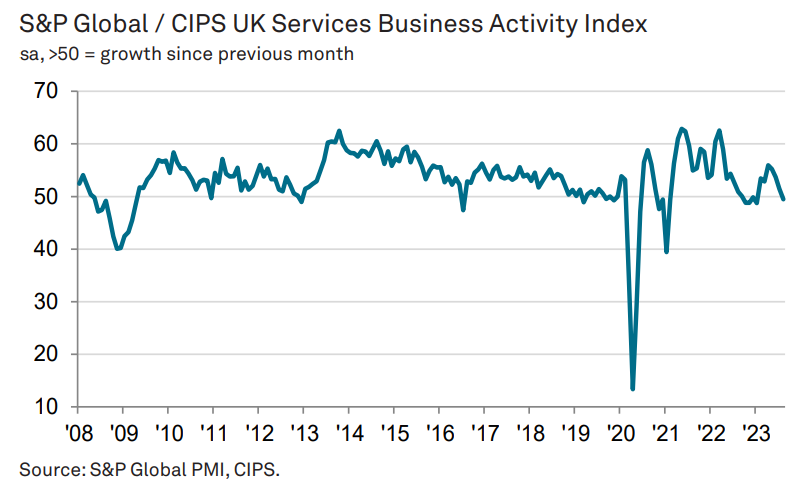

The services purchasing managers’ index (PMI), compiled by S&P Global and CIPS, fell to 49.5 last month, down from 51.5 in July. The 50 mark separates growth and contraction.

While the reading signalled a contraction, it was higher than economists expected and revised upwards from the initial flash estimate of 48.7. PMI data is closely watched for indications about future economic activity.

Service providers typically noted caution among clients and fewer new business opportunities, linked to rising interest rates, squeezed disposable incomes and worries about the economic outlook.

“After a modest recovery over the past six months, service sector businesses are now clearly feeling the impact of rising interest rates on client demand,” said Tim Moore, economics director at S&P Global Market Intelligence.

“Worries about the broader business climate also dampened spending in August, with firms suggesting that faltering UK economic growth and sticky inflation were weighing on the outlook,” he added.

New orders from overseas increased at the slowest pace since December last year with Brexit cited as a constraint on sales to EU clients.

The survey also showed the fastest decline in backlogs of work for more than three years thanks to a fall in the volume of new orders.

“The hesitation to commit is likely to be the landscape for the next few months as the UK economy becomes a riskier environment for domestic and overseas business alike and competition amongst service providers intensifies,” said John Glen, chief economist at CIPS.

Although output declined, the rate of input price inflation was the joint lowest since May 2021. Falling costs and an increasingly competitive market meant that there was the weakest rise in prices charged by firms for two years.

The composite PMI, which combines today’s data with figures from the manufacturing sector released last week, fell to 48.6 in August.

Experts were more optimistic for the future of the UK economy than the gloomy PMI data implied, suggesting that the UK would avoid recession later in the year.

Martin Beck, chief economic advisor to the EY ITEM Club, said “Q3 GDP growth is likely to come in stronger than recent PMI readings imply”.

Similarly, Samuel Tombs at Pantheon Macroeconomics said the PMI was probably giving a “misleading read on the economy’s momentum”.

He noted the recent improvement in business confidence and said that falling energy prices and rising incomes will help GDP grow 0.2 per cent in the third quarter.

The UK’s data comes shortly after figures showed business activity in the eurozone dropped further than initially thought, falling to its lowest level since the pandemic.

Hamburg Commercial Bank’s final composite PMI fell to 46.7, far below the 50-no change mark and lower than the flash estimate of 47.0.

Cyrus de la Rubia, chief economist of Hamburg Commercial Bank, said although the eurozone avoided recession in the first half of the year, the “second half will present a greater challenge”.