Recession looms over European economies grappling with soaring gas prices

Recession is looming over Europe’s largest economies, driven by record inflation fuelled by high energy prices squeezing businesses and households, surveys published today showed.

Consumers on the Continent are shrinking spending in response to record inflation sharply hitting their finances.

Elevated gas costs, caused by Russia seemingly retaliating to western sanctions after the Ukraine invasion and a sudden uptick in demand after the Covid-19 unlocking, have cooled business activity.

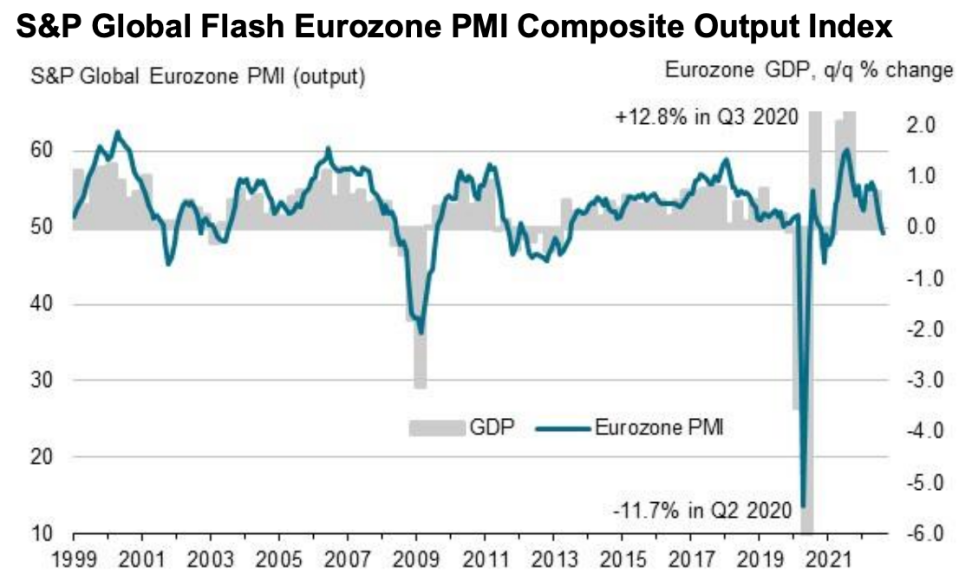

According to S&P Global’s latest purchasing managers’ index (PMI), output in the group of 19 countries that use the euro fell for the second month in a row and to an 18-month low.

The bloc’s PMI dropped to 49.2 this month, down slightly from July. A reading below 50 points indicates most businesses reported shrinking output in August.

The figures sparked economists to warn the eurozone economy is in the early stages of a prolonged recession that will get worse unless gas prices drop from record highs.

Andrew Harker, economics director at S&P Global Market Intelligence, said: “The latest PMI data for the eurozone point to an economy in contraction during the third quarter of the year.”

Factories are struggling to shift stock they hoovered up to avoid being hit by supply chain disruption due to falling demand, Harker added.

Inflation has surged to its highest level since the creation of the euro in 1999, primarily driven by soaring gas prices. Yesterday, the area’s benchmark gas price hit a new record high.

Europe has for decades relied on cheap Russian gas to generate output. Weaker Russian energy flows have thrown the bloc’s economic model into disarray.

Germany’s economy, the eurozone’s powerhouse, is wilting under the weight of sky-high gas prices and nearing recession, with its August PMI dropping to a 26-month low of 47.6.

The numbers paint “a bleak picture of the German economy,” Phil Smith, economics associate director at S&P Global Market Intelligence, said.

France’s economy also slumped to contraction territory, posting a 49.8 reading.

Despite the downturn, the European Central Bank (ECB) is set to hike interest rates at a rapid pace to tame prices, experts said.

“The PMI surveys are consistent with our view that the ECB will have to press ahead with monetary tightening even as the economy falls into recession,” Jack Allen-Reynolds, senior eurozone economist at Capital Economics said, adding he expects president Christine Lagarde and co will send rates 100 basis points higher by December.