‘Recession increasingly likely’ as business output drops sharply under weight of higher interest rates

A steep downturn in services saw economic activity contract at its fastest pace since the financial crisis – outside of the pandemic – raising the chances of a recession, a closely watched survey suggested.

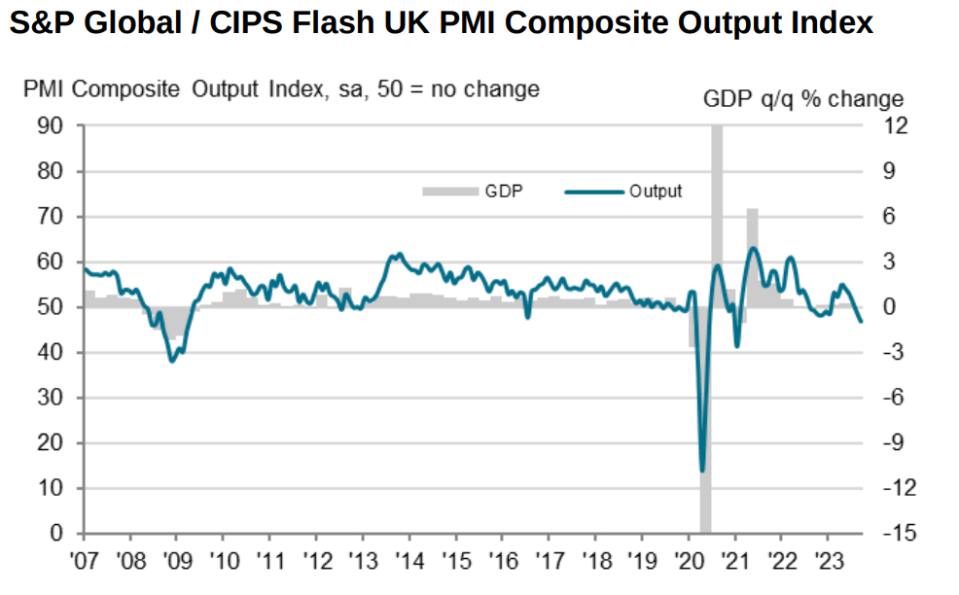

S&P Global’s Purchasing Managers’ Index (PMI) for the UK economy came in at 46.8 – far below the 50 reading which indicates flat growth. The PMI assesses the health of an economy’s services and manufacturing sector.

Falling from a reading of 48.6 last month, the downturn was the steepest since the financial crisis when excluding the pandemic era. Analysts had predicted a reading of 48.7 this month.

The UK’s all important services sector fell to 47.2, a 32-month low and down from 49.5 last month. Service providers reported the steepest fall in new work since November 2022 with businesses attributing the fall to rising interest rates and economic uncertainty.

Manufacturing meanwhile saw a slight improvement, rising to 44.2. Although this was still deeply in contraction, it was a two month high.

Cost of living pressures and higher borrowing costs were denting demand in both sectors, respondents said.

Chris Williamson, chief business economist at S&P Global Market Intelligence said: “The disappointing PMI survey results for September mean a recession is looking increasingly likely in the UK.”

John Glen, CIPS chief economist, said the survey “echoed survey records seen in the last economic crash over a decade ago.”

Although the survey showed that business output was falling fast, it signalled that inflation would continue to ease over the coming months.

Firms were shedding workers at the fastest pace since October 2009, when excluding the pandemic, as budget constraints were encouraging firms to not replace voluntary leavers.

Williamson pointed out that with a sharp fall in employment, “wage bargaining power is being eroded rapidly”.

The data also pointed to the slowest rise in private sector business expenses since January 2021. Falling commodity prices were helping to offset higher wage and fuel costs.

Rate-setters at the Bank of England were given early sight of the data, which likely influenced their decision to leave interest rates on hold yesterday. Many MPC members have highlighted wage growth as a crucial indicator of inflationary persistence.

The sharp slowdown in business output reflects the impact that rising interest rates have had on cooling the economy. In response to surging inflation, the Bank Rate has been raised to a post-financial crisis high of 5.25 per cent.

John Glen, CIPS chief economist, said the impact of the rate hikes was “leaking the life blood out of private sector business”.

Rhys Herbert, senior economist at Lloyds Bank, argued that the data “reinforces expectations in the market that interest rates are now at a peak.”

Some analysts suggested that the economy may already be in recession after GDP contracted 0.5 per cent in July.

The Bank of England updated its growth forecasts for the remainder of the year, warning that GDP would rise “only slightly” in the third quarter while underlying growth would be “weaker than expected” too.