Recession in “full swing” as inflation puts small businesses in “critical” state

Recession in Britain is now in full swing with experts warning of a “critical” situation for small businesses up and down the country, according to fresh data, as the economy turns sour to start 2023.

Brits are reining in spending to withstand the impact of record-high inflation on their budgets, resulting in one in four of the more than 5,600 businesses surveyed by the British Chambers of Commerce (BCC) in November registering a fall in sales.

The BCC warned its quarterly survey has settled at “concerningly low levels,” indicating the well-warned UK recession has set in.

Britain is on course for an at least year-long slump, driven by rising prices and business costs curbing economic activity.

The hit to balance sheets from a slowdown in demand is being compounded by a sharp rise in energy costs, prompting experts to warn a wave of small businesses could go bust this year.

“The situation remains critical for the majority of SMEs who find themselves cut adrift by monumental inflationary pressures, often driving triple-digit percentage cost increases, particularly on energy,” David Bharier, head of research at the BCC, said of the economy.

Last night, the Treasury confirmed Chancellor Jeremy Hunt told business leaders to brace for the government to water down energy bill support from this spring.

The Treasury has been covering around half of business energy costs since last autumn.

Hunt is expected to halve the support package after it ends in its current form in March by ensuring it targets businesses more exposed to potential further surges in gas and electricity prices, which some fear will do more damage to the economy – although it will make the public finances healthier.

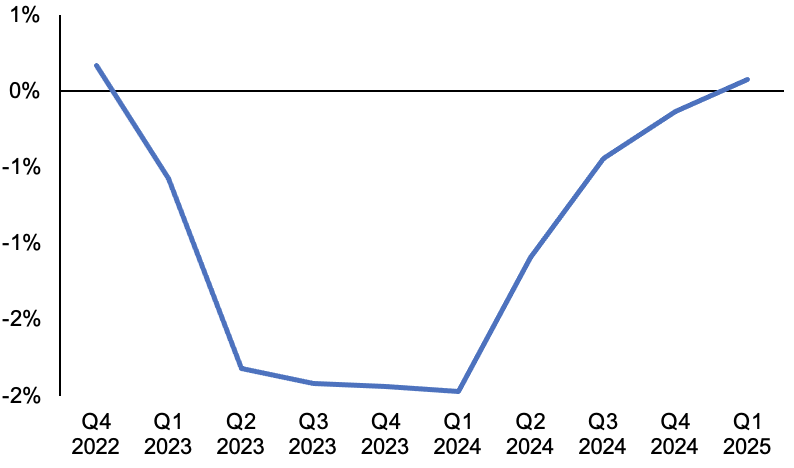

Britain is on track for a long slump

However, the BCC found nearly two thirds of companies expect to lift their prices this year to protect margins squeezed by higher costs, suggesting inflation still has some staying power in 2023.

The survey indicated firms are increasingly sweating over higher taxes and interest rates.

Hunt lifted taxes significantly as part of a £55bn autumn budget, while the Bank of England has hiked rates nine times in a row to 3.5 per cent, their highest level since 2008, to tame inflation.