Recession fears outweigh OPEC+ cuts amid oil price slump

Oil markets will open tomorrow with prices weighed down by global recession fears and weakening oil demand.

This outweighed OPEC+’s bid to boost benchmarks with swingeing production cuts.

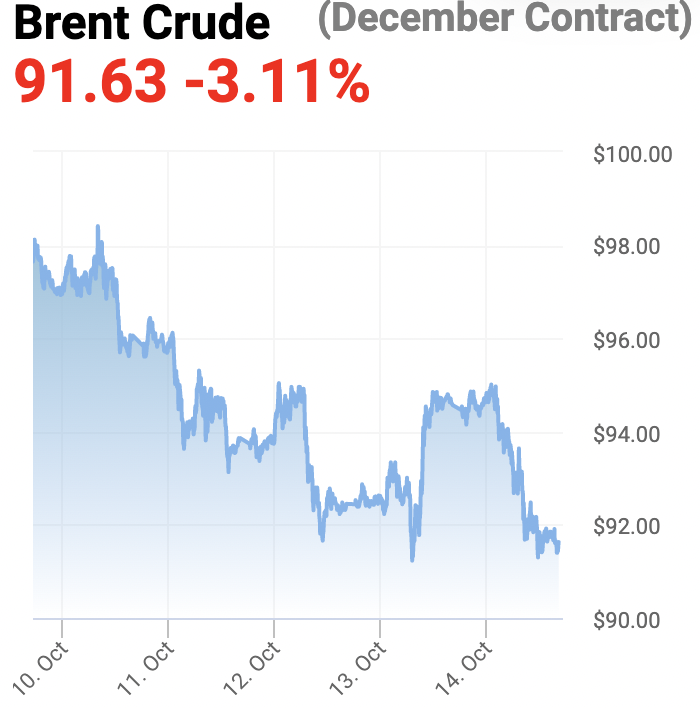

Both Brent Crude and WTI Crude will begin trading down three per cent, priced at $91.63 per barrel and $85.61 per barrel respectively.

OPEC+ met in Vienna, Austria, earlier this month and agreed to slash output 2m barrels per day, aiming to prop up prices which had slid from a 14-year high of $139 per barrel in March to below $90 per barrel earlier this month.

However, despite an initial bounce, prices have dipped again, with China’s strict zero-Covid strategy strangling demand and driving down prices.

China is the world’s largest crude oil importer and has been stamping down on Covid-19 flare-ups after a week-long holiday, although its infection tally is small by global standards.

President Xi Jinping has signalled there will be no immediate loosening of the policy, describing his approach at the latest party congress as a “people’s war to stop the spread of the virus.”

Resurgent US dollar hurts overseas oil buyers

While the two contracts whipsawed between positive and negative territory for much of Friday, Brent Crude fell for the week by 6.4 per cent and WTI Crude slipped 7.6 per cent.

Alongside Chinese lockdowns, US interest rates are sitting at three per cent, with the Federal Reserve grappling with the biggest annual increase in inflation, which has also driven down demand.

Meanwhile, the US dollar remains robust – rising around 0.8 per cent – making fuel more expensive for buyers using other currencies.

The International Energy Agency slashed its oil demand forecast last week, and has warned OPEC+ risks catalysing a global recession through its heavy cuts.

Meanwhile, the US and Saudi Arabia are at loggerheads over the production cuts, with relations already strained amid persistent failures from the cartel to reach its output targets this year.

President Joe Biden has warned he will have to reconsider the US relationship with Saudi Arabia, with the White House eager to drive down the cost of living ahead of key mid-term elections next month.