Reasons to be cheerful? Why the UK could dodge a recession

Gloomy projections abound for the outlook of the UK economy, reflecting its stubbornly high rate of inflation and the delayed impact of the Bank of England’s aggressive monetary tightening.

The most recent forecasts from the Bank of England suggest that the UK will be stagnant across all of next year. The International Monetary Fund (IMF) meanwhile thinks that it will eke out 0.6 per cent growth, the slowest of the major economies.

But forecasters have been wrong before. This time last year the Bank of England predicted the longest recession in the UK’s history, and the IMF predicted at the beginning of the year that the UK would be the only major economy to shrink in 2023, expecting a 0.6 per cent contraction.

Yet so far, no recession.

After the most recent GDP figures for the third quarter, it is all but certain that the UK will avoid a contraction this year. So are there still reasons to be optimistic about the UK’s performance over the coming months?

To know where the UK economy is heading, you need to know what the Great British consumer is up to. Consumption makes up around 60 per cent of UK aggregate demand, by far the largest component.

At first glance, it hardly makes for happy reading. Recent retail sales figures pointed to a significantly stronger than expected downturn, with sales falling to their lowest level in two years.

Capital Economics estimates that two million fixed-rate mortgages are set to expire between the end of this year and next, forcing households to pay significantly more in monthly repayments. .

The consultancy thinks that around two thirds of the increase in rates is yet to be felt, pointing to a further impact on consumer spending power in the coming months.

But this only makes for one half of the equation. The question is whether the impact of higher mortgage rates will offset the real income boost households are receiving now that inflation is rising at a slower pace than wages.

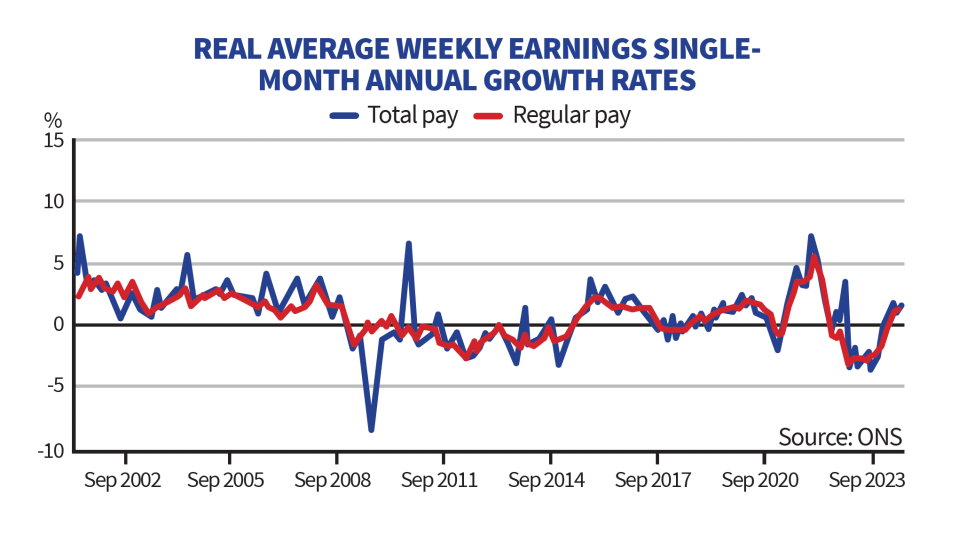

In October, figures revealed that inflation had fallen below annual wage growth for the first time in 18 months. With inflation falling fast over the next few months, wage growth will continue to outpace price rises giving households a real income boost.

Analysts at Pantheon Macroeconomics expected a 1.5 per cent increase in real household disposable income in the fourth quarter. Over 2024, real income will grow around 1.2 per cent compared to the previous year.

Falling inflation means markets now think that interest rates have peaked and will start falling next summer, which will mean new mortgage rates ease from their recent highs.

“The effective interest rate on the stock of mortgages will likely rise at a slower pace in 2024 than in 2023, squeezing total disposable income by only 0.1pp per quarter, half this year’s pace.” Gabriella Dickens, senior UK economist at Pantheon, said.

Households have also actually seen a “net benefit” from higher interest rates, Martin Beck, chief economic adviser the EY Item Club said.

Interest rates paid on savings products have increased faster than the effective rate paid on mortgages, that is the rate that mortgage holders are actually paying.

The fact that a number of households have not yet moved onto higher rate mortgages, the higher rate environment has in fact mostly been a boost for households – particularly wealthy ones.

This has been a tailwind over the past few months, although it will likely reverse as more households move onto higher mortgage rates.

But Simon French, head of research at Panmure Gordon, pointed out that its not just about crunching the numbers. French, who expects the UK to grow 1.25 per cent next year, argued that predictions about the state of the UK economy essentially rest on how much extra saving consumers do.

“The judgement is whether households, faced by all this barrage of news, undertake more of what’s known in economic circles as precautionary saving,” he said.

In the most recent Monetary Policy Report, the Bank of England forecast that the share of households who are planning to save more than usual over the next six months will rise to about half.

But French points out that households’ balance sheets are in their strongest position for years. Households have been deleveraging since the financial crisis, leaving them in a stronger position to face a downturn.

Given that, there is no reason to assume that households will behave in the same way as previous downturns because the starting point is different.

“My judgement is they won’t add to their cash balances in the same way as they did in 1990 and 2008,” he said. “Excess savings from the pandemic is just the most recent chapter in a longer story”.