Real Estate: COVID-19 may permanently quarantine inflexible leases

Real estate leases have long represented a point of disagreement between accountants and financial analysts.

This disagreement was the primary reason why the London-headquartered International Accounting Standards Board (IASB) and the US Financial Accounting Standards Board (FASB) went separate ways in finalising lease accounting standards.

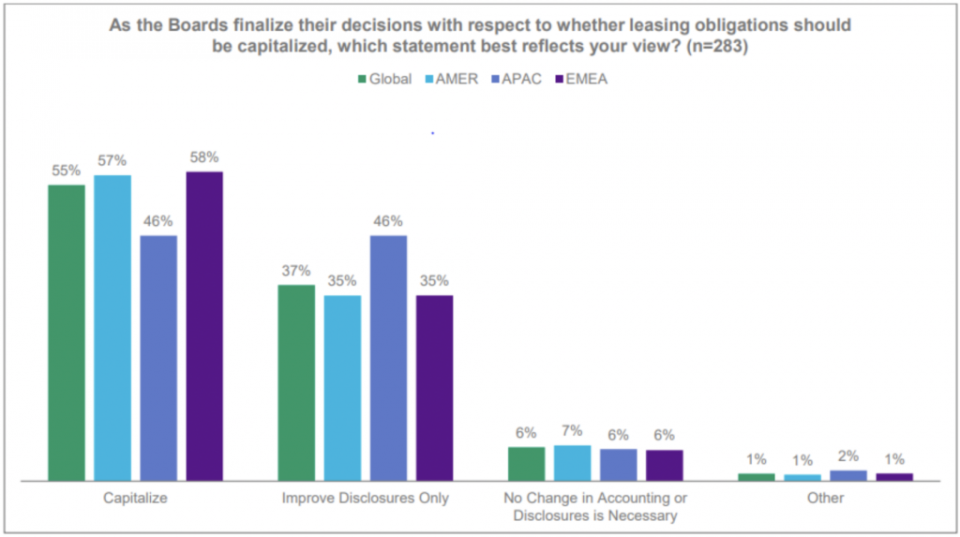

Figure 1. Lease Accounting Survey Report (October 2013)

For a very long time, real estate leases remained off-balance sheet in accounting and on-balance sheet in investor analysis. The investors’ argument is based on an economic assumption — that is, businesses operating for the foreseeable future need a real estate asset. A significant shift to the digital economy, however, has raised questions about the longevity of a bricks-and-mortar-only business. The impact of the coronavirus pandemic could further accelerate this shift.

Numerous bricks-and-mortar-only businesses may not survive the highly likely recession in 2020. And those that survive will have no other choice but to move on a war footing to join the digital economy. Therefore, a post-coronavirus normalisation will see lessees more determined to negotiate flexibility in lease contracts, and the overcapacity of commercial property could make landlords more willing to accept such demands.

Online Disruption

Economically, real estate leases behave differently from debt obligations. Therefore, even in cases in which these are analytically adjusted as debt, these generally are referred to as “debt-like” obligations.

However, the online disruption has turned the economic assumption upside down.

A notable case study is Sears, founded in 1893 and was the dominant retailer in the United States. Its business idea of a mail catalog became the foundation of its growth story. From the 1920s, Sears built its department stores and expanded outside its home country. From the 1950s to the 1970s, it expanded from suburban markets to malls. At its peak, it was selling everything from tools to houses. However, from the 1980s onward, Sears missed out on female consumers as an important demographic group, and new competition emerged from discount retailers (e.g., Walmart). The final hit came from online competition, and the group filed for insolvency in 2018.

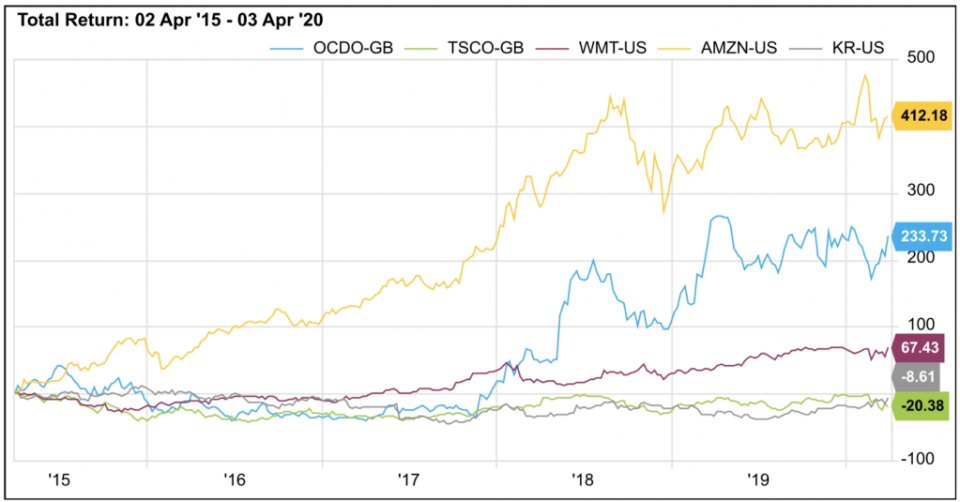

As one great business idea faded away, another replaced it. Ocado (a UK-based online grocery retailer) set up a business model based on its bet that online sales would rise as the tech-savvy younger population switched to purchasing groceries online. It made losses for a long time, but overnight, it became a key service provider to bricks-and-mortar retailers when Amazon announced its acquisition of grocery chain Whole Foods in June 2016. The legacy retailers realised that the digital economy was no longer a niche market. Ocado’s total return over the past five years captures its story as legacy businesses started signing up deals to get a foothold in the digital economy.

Figure 2. Ocado’s Total Return (2015–2020)

Cognitive Bias

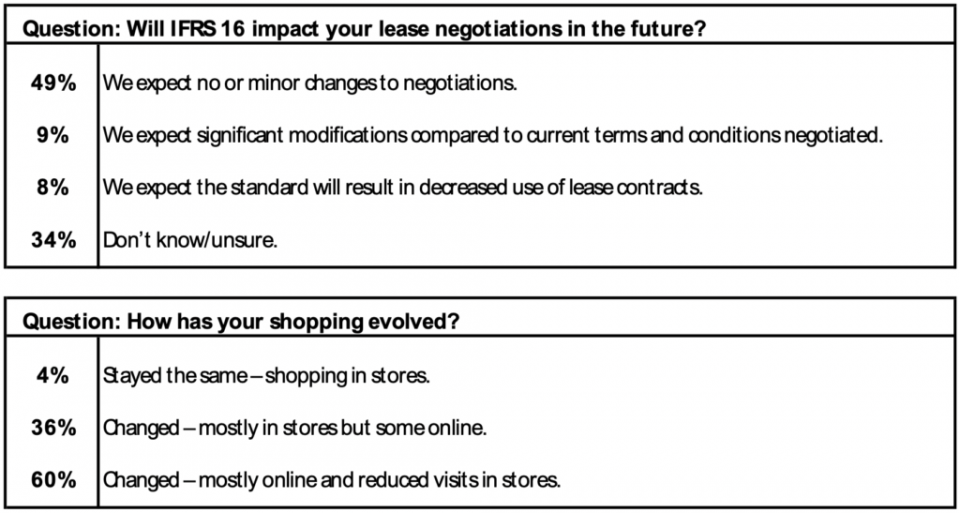

In a webinar hosted by Institute of Chartered Accountants of England and Wales (ICAEW), “IFRS 16 Leases — The Impact,” in May 2019, 389 finance professionals were asked two questions to gauge their assessment of whether struggling bricks-and-mortar retailers facing increased online sales coupled with the new leasing standard[1] would see changes in future lease negotiations.

Figure 3. Changes in Future Lease Negotiations

In response to the first question, only 17% expected that changing economics and accounting standards would result in either significant modifications or decreased use of leases contracts.

In response to the second question, 96% of the participants mentioned that their shopping habits had changed.

The combined results could be explained with a cognitive bias. When things do not change for a long time, they are expected to remain the same. The survey responses confirmed the online shopping trend and the upcoming overcapacity problem for landlords.

An Intu Properties PLC press release in March 2020 noted the status before the impact of the pandemic:

The independent valuations of intu’s portfolio at 31 December 2019 delivered a valuation deficit of £2bn for 2019, a like-for-like decrease in value of 22% for the year and around 33% from the peak valuation in December 2017. Weak sentiment rather than hard transactional evidence has been the key driver in the valuation deficit with net initial yield (topped-up) increasing by 95 bps to 5.93%.

Post-COVID-19 Recovery

The recent COVID-19 lockdown has brought the global economy to a standstill. It has created new winners and losers. In the current crisis, players in the digital economy would come out as big winners.

According to a review of global retailers with combined revenue of around $5 trillion on FactSet, an annual rental cost of $136 billion was reported on 2018 financial statements. This amount accounts for about 2.7% of the combined turnover. For retailers earning less than $1 billion, the five-year average rental costs means 5.9% of turnover. Therefore, if sales remain depressed, the small retailers would be hit the hardest as the five-year average Earnings Before Interest and Tax (EBIT) margin was around 2.6%.

The lockdown, irrespective of how long it lasts, will:

- Accelerate a shift to online shopping for consumers;

- Force surviving retailers to aggressively pursue a shift to digital economy;

- Make businesses rethink their commitment to renting office spaces when modern technology could be used to chip away at this fixed cost; and

- Make businesses renew their lease contracts with maximum flexibility and link to the variability of store sales to reduce overall leverage.

WeWork may have been a bad business model for an intermediary. This important technology solution, however, may address the overcapacity issue for landlords. Significant shifts in consumer habits, the aging population, and increased gig-economy workers are creating a secular trend that will become increasingly prominent with the passage of time. If this is the case, then the commercial rental income could become more volatile and cyclical in the future.

Real Estate leases as operating leverage has technology back-up

The majority view and the underlying economic assumption may be coming to an end. The minority view to treat real estate leases as operating leverage now has the technology and macroeconomic changes on its side. Only the post-COVID-19 recovery will reveal whether these changes will happen in the near or the long term.

As technology-driven services replace unintelligent physical assets, these need to be captured both as an asset and as an obligation in accounting. Whether service obligation is an operating or financing leverage is a discussion for another day.

Originally published at CFA Institute Market Integrity Insights. If you liked this post, don’t forget to subscribe.

By Kazim Razvi, Director of Financial Reporting Policy at CFA Institute.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

[1] IFRS 16 and US GAAP 842 Leases went into effect 1 January 2019. The new lease standards require real estate leases to be capitalized as debt on balance sheet.

Image Credit: © 2020 CFA Institute