RBS to sell stake in US subsidiary Citizens Financial

Royal Bank of Scotland will shrink its stake in its US subsidiary Citizens Financial to below 50 per cent.

Citizens Financial has announced RBS will sell off 115m shares in the company which only listed on the New York Stock Exchange in September.

RBS will also grant the underwriters – including Morgan Stanley, Goldman Sachs and J.P. Morgan – an over-allotment option to purchase up to 17.25m additional shares which would cut its stake to 46.1 per cent from its current 70.3 per cent holding.

Citizens Financial’s initial public offering (IPO) was the second-biggest in the US in 2014, behind Alibaba’s record-breaking IPO, raising $3bn (£2.01bn).

The retail bank holding company had $132.9bn of total assets as of 31 December 2014 with approximately 1,200 branches in 11 states across the US.

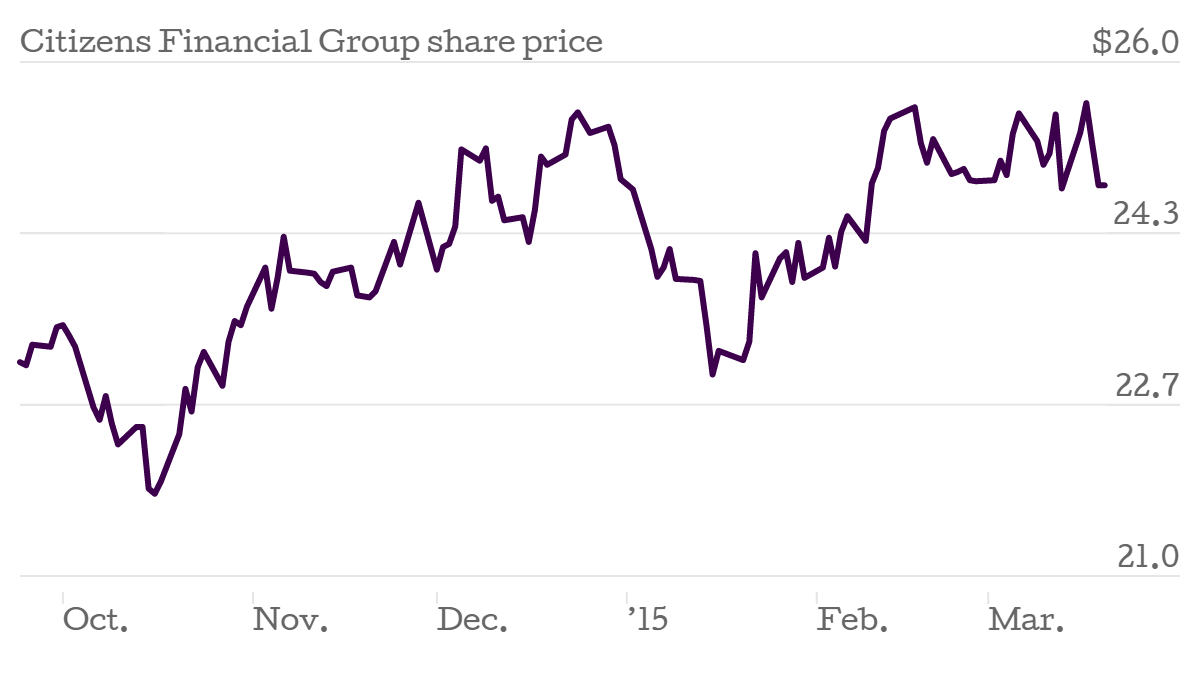

Its share price has risen 15 per cent from its IPO price of $21.50 per share to Friday’s closing figure of $24.80.