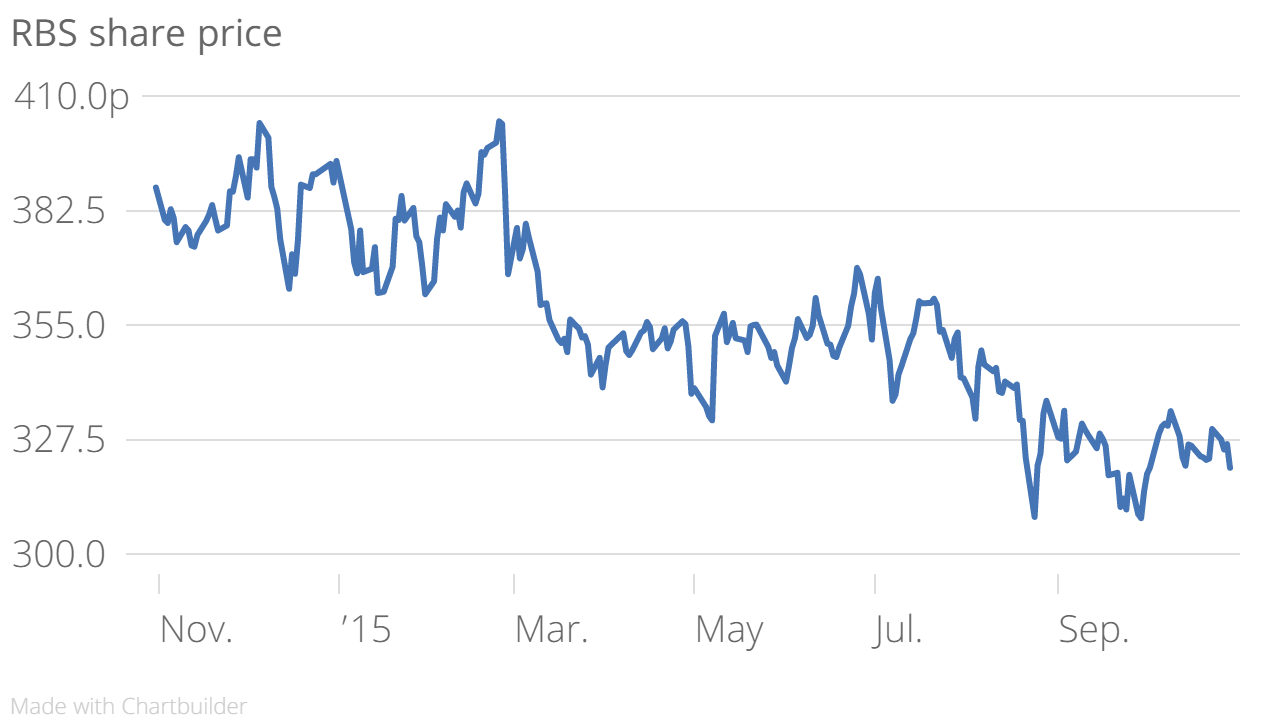

RBS’s share price falls as it reports decline in third quarter profits missing estimates

Royal Bank of Scotland has reported third quarter adjusted operating profits down more than half, missing expectations. The lender's shares fell one per cent to 317.40p as the markets opened on the news.

The figures

The bank said pre-tax profit before one time items and restructuring costs fell to £842m, from £2bn a year ago, after £126m of losses relating to IFRS volatility, and £77m of CIB disposal losses.

Third quarter operating loss was £134m, down from a profit of £1.1bn for the same period a year ago.

Total income fell to £3bn, down from £3.6bn in the third quarter of last year, largely due to the reduction of the investment bank.

The bank also reported £847m of restructuring costs during the three months, and £129m of conduct and litigation charges – largely to cover mortgage-backed securities cases.

There was some good news: the bank said it had sold the rest of its 20.9 per cent stake in US lender Citizens.

Why it's interesting

The government may have kicked off its long-awaited selloff of shares in its stake back in August, but the bank has missed expectations by some way. Analysts had expected a profit of £988m, against the £842m reported.

RBS was rescued at a cost of £45.8bn during the financial crisis, leaving the government holding an 81 percent stake.

Read more: RBS and Patron Capital sell 32 UK hotels

In February chief executive Ross McEwan said there would be a major restructure of the bank, which will involve scaling back investment banking operations and leaving 25 of the 38 countries in which it operated. The idea was to focus on UK retail and commercial banking.

The bank said the fourth quarter looks equally as bleak in terms of restructuring costs which it expects to "remain high as we continue to implement our core bank transformation and disposal losses to be elevated within the overall guidance on disposal losses, although the timing and quantum of these losses are subject to market conditions."

Read more: RBS is rebranding (but you probably won't notice

RBS isn't the only one having a tough time: yesterday Barclays reported a 10 per cent fall in adjusted pre-tax profit to £1.43bn for the third quarter, from £1.85bn last quarter and £1.59bn for the same period a year ago. Reported adjusted pre-tax profit missed analysts' expectations.

What RBS said

The bank said in a statement:

Whilst legacy issues continue to be addressed, material further and incremental costs and provisions in respect of conduct and litigation related matters are expected, and could be substantially greater than the aggregate provisions RBS has recognised

In short

Adjusted operating profit fell by over a half in the third quarter compared to last year due to losses relating to IFRS volatility as well as CIB disposal losses.