RBS’ recovery hurt by German Coutts tax probe

RBS’ SHARES took a tumble yesterday as the bailed-out bank warned of more legal costs to come, including a tax evasion investigation by German authorities into its private banking arm Coutts.

The revelation came as the bank reported falling losses for 2014 as its cost-cutting programme outpaced the decline in revenues.

It lost £3.5bn in the year, down from £9bn in 2013 and its lowest annual loss since it was bailed out. Its operating profits, on the core business, swung from a £7.5bn loss to a £3.5bn profit.

But the figures were worse than expected. RBS racked up another £2.2bn of conduct and litigation charges, which included an extra £400m in PPI redress costs, despite earlier hopes the problem was almost over.

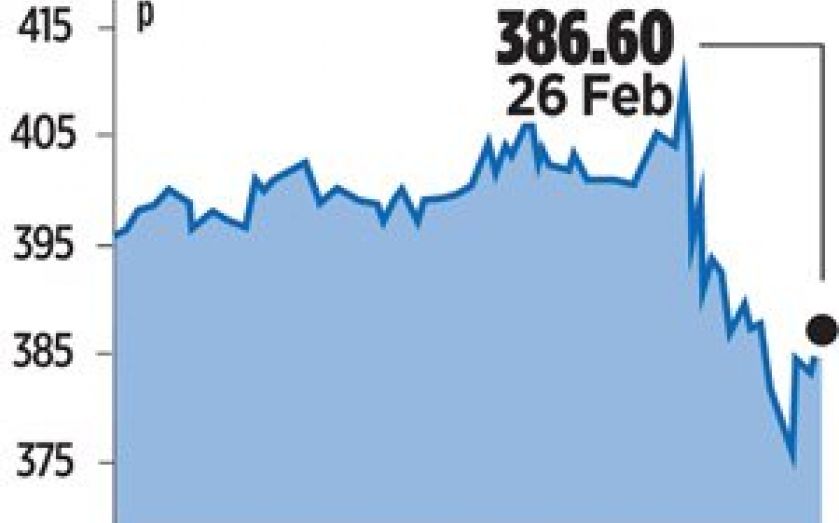

The bank’s shares initially rose as investors welcomed falling losses over 2014 – the price peaked at 414p, above the 407p price at which the government would break even on its bailout.

But sustained legal costs, with the potential for more to come, drove the shares down again. The stock closed at 386.6p, down 4.14 per cent.

The bonus pool for the bank contracted from £536m to £421m, in part as the bank continues to cut back investment banking operations. Chief executive Ross McEwan turned down his £1m bonus. George Osborne welcomed the decision, reminding bosses RBS is 81 per cent taxpayer-owned.

“Given the extraordinary support it has enjoyed in the past from taxpayers, I know you recognise that RBS must remain a back-marker on pay and continue to show responsibility and restraint,” the chancellor wrote.