Rathbone unit trusts help fund base surge 20pc

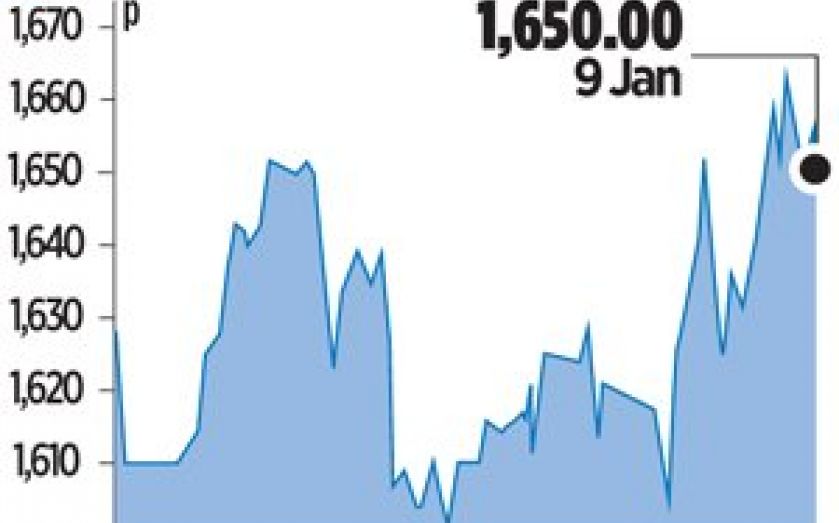

RATHBONE Brothers, the upmarket wealth manager, yesterday said the amount of money it manages for people jumped by over 20 per cent last year, boosted by its unit trust business.

The company, currently on the hunt for a new chief executive to replace Andy Pomfret who departs next month, saw funds managed by the company add £4bn in the 12 months of last year, taking the total to £22bn.

A late surge in the fourth quarter helped assets rise nearly six per cent, or £1.2bn.

Rathbones, descended from the notable family merchants based in Liverpool, offers services to well heeled high net worth individuals, offering investment, tax and savings advice.

Current boss Pomfret announced plans to stand down next month after a decade at the helm.

Yesterday’s figures show he will leave the funds business in good shape after a surge in interest for its unit trusts, a type of mutual fund.

Its suite of trusts saw £170m flow to the funds in the final quarter, compared to just £14m in the same quarter last year.

The company was bullish in its statement to the market yesterday.

“Rathbones remains well positioned to take advantage of growth opportunities as they arise and continues to consolidate its position as a leading provider of high-quality, personalised investment and wealth management services,” it said.