Rathbone boss leaves on a high as assets tick up

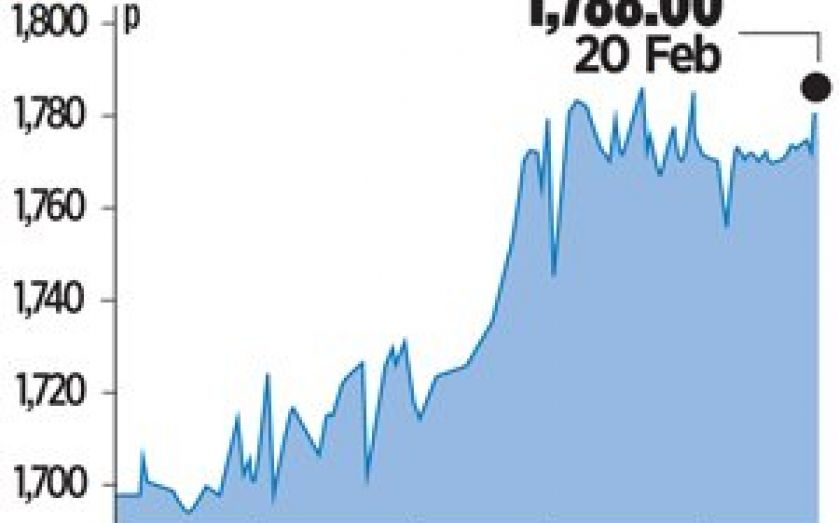

WEALTH manager Rathbone Brothers ushered in a new era yesterday after long standing boss Andy Pomfret handed the reins over to the company’s new chief executive, as it reported double digit asset growth for last year.

Pomfret, who has been an executive at the company for 15 years, leaves the business next Friday to be replaced by Philip Howell, who has been deputy chief executive since March 2013.

“It’s been really enjoyable and the shareholders should be reasonably happy with what we’ve done,” Pomfret said. “I’m not retiring and going into the void, I’d like a serious non-executive role next and the only non-executive role I haven’t done so far in my career is chairman.”

Pomfret, who has a non-compete clause for six months as part of his exit from Rathbones, leaves the company in good shape.

Its well-heeled client base added £900m more cash to its funds in 2013 than the £400m added in the previous year, helping drive underlying organic asset growth to 5.4 per cent from three per cent, according to results released yesterday. Assets under management rose 22 per cent to £22bn while pre-tax profits rose 14.8 per cent to £44.2m.

Howell, who previously spent 24 years at Barclays, said pushing for stronger relationships with independent financial advisers (IFAs) was one avenue the firm was hoping to pursue in future to increase clients.

Rathbones operates at the higher end of the wealth market, with its discretionary service offered to people with a starting minimum of £100,000 to invest.